New Delhi, May 27: The Central Board of Direct Taxes (CBDT) has extended the due date for filing Income Tax Returns (ITRs) for the Assessment Year 2025-26 from July 31 to September 15, 2025.

In an official statement issued on Tuesday, the CBDT cited extensive changes in the notified ITR forms and the time needed for system readiness as key reasons for the extension. “To ensure a smooth and convenient filing experience, the due date for filing ITRs, initially set for July 31, 2025, has now been extended to September 15, 2025,” it said, adding that a formal notification will be released shortly.

The department also noted that Tax Deducted at Source (TDS) statements, originally due by May 31, 2025, will likely be reflected only in early June. This delay would have shortened the filing window for many taxpayers, justifying the extension.

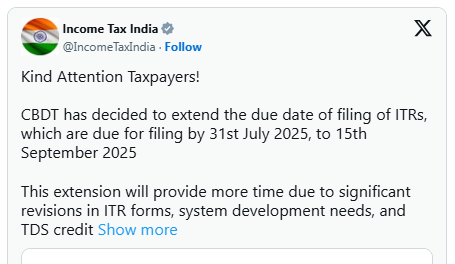

Highlighting the need for accuracy and user convenience, the Income Tax Department posted on X (formerly Twitter):

“This extension provides more time to accommodate major revisions in ITR forms, system updates, and TDS credit processing—ensuring a more accurate and hassle-free filing experience for all.”