New Delhi, August 15: In a significant move toward simplifying the Goods and Services Tax (GST) structure, the Central government has proposed a major overhaul by eliminating the existing 12% and 28% tax slabs.

Government sources confirmed on Friday that the revised framework would retain only the 5% and 18% GST rates for most goods and services.

According to sources, under the proposed plan, 99% of items currently taxed at 12% would shift to the 5% slab, while 90% of goods in the 28% category—including many consumer items—would be moved to the 18% bracket. However, a new 40% GST slab is being considered exclusively for so-called "sin goods" such as tobacco products and pan masala.

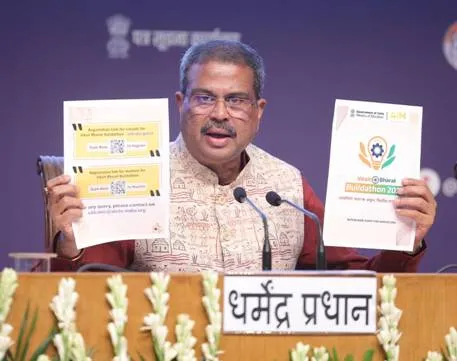

This proposed restructuring aligns with Prime Minister Narendra Modi's Independence Day address, in which he hinted at a major Diwali "gift" for citizens and announced the beginning of a "next-generation" GST reform initiative.

"This Diwali, I am going to make it a double Diwali for you. You're going to get a very big gift," the Prime Minister declared from the Red Fort. “In the last eight years, we have undertaken significant GST reforms, reduced the tax burden across the country, and simplified the system. Now, it's time for a comprehensive review.”

He added, “We have formed a high-level committee and consulted with the states. The next phase of GST reform will ease the tax burden on the common man, reduce prices of everyday items, and significantly benefit MSMEs and small entrepreneurs—ultimately giving a boost to the economy.”

The Centre’s proposal has been shared with the states and the Group of Ministers (GoM) under the GST Council. The GoM is expected to review the recommendations, with a GST Council meeting likely to be scheduled between September and October to deliberate on the reforms.

If approved, this sweeping tax overhaul could mark one of the most significant changes to India's indirect tax system since the GST was first implemented in 2017.

(With agency inputs)