Bhubaneswar: The leadership style of Donald Trump 1.0 when he was first inaugurated as the 45th President of the USA had been ‘Unedited’, Unfiltered’, ‘Off the Cuff’ and ‘Unplugged’, as described by author of the book, Lessons In Leadership, Steve Adubato.

Since Trump ushered into the high office of White House without any wide political experience in 2016, he had such a style of leadership, but after a stint of 4 year at the White house and later fought a hard-pitched battle to make this stunning comeback, and in doing so, Trump has added many years of political experience, so, the moot question now is will Trump 2.0 see any change in leadership style?

Preseident Trump in 2016-2020 was unpredictable. The scenario in 2024 is, now, he seems more predictable when one analyses his averments in political campaign speeches and debates. Since Trump 2.0 was made possible by languishing American economy, a look at the following reports will give a sneak-peek to the impact on Indian consumers courtsey Uncle Sam.

HOW WILL BE TRUMP 2.0?

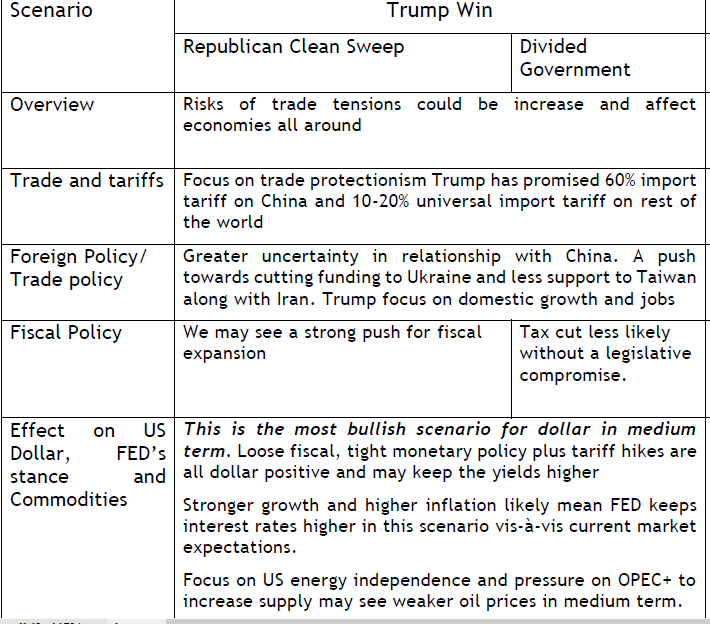

The mood on Trump 2.0 has been outlined well by reputed global investor rating agency Moody. As per the Moody report, with Republican gaining control in Senate and Congress, President Trump will take the following for sure.

Now Take A Glance At Union Bank of India report

The report says the Trump win, and if he stays true to his words, he promised to impose 60% tariff hike on China and implement loose fiscal policy. His campaign proposals to raise tariffs, maintain loose fiscal policy are, therefore,

HOW STRONG DOLLAR WILL IMPACT INDIAN RUPEE?

The Union Bank of India report highlighted that the domestic currency Rupee broke the major psychological level of 84/$ on 11th Oct’24 and touched a high of 84.10/$ after trading in a tight range of 83/$ corridor for almost 2 years (since Oct’22).

It added that since June’24, unlike Asian peers, Rupee was the worst performing currency and was hovering close to its then all-time lows but the downside (Psychological barrier of 84.00) was largely protected by continuous Dollar sales by Foreign Portfolio Invetsors in the domestic equity & debt market.

However, in recent weeks when all the emerging-market currencies took a hit amid rising Dollar strength, Rupee remained one of the least volatile currencies and refrained from depreciating much.

TRUMP 2.0 WILL DRIVE OIL PRICES UP OR DOWN?

As per the analysis of the Union Bank of India, Trump administration and Republican majority in Senate will pursue the policy of US energy independence, which will put pressure on the OPEC+ to increase oil supply that could lead to weaker oil prices in medium term.

The analysis thus suggests a big drop likely in global crude prices soon, post Trump win, which will then impact the high prices of petrol and diesel in India. And consumers in year 2025 may soon see cut in the prices of such petro fuels.

View the details of impact of Trump win in the table below.