Bhubaneswar: Indians are getting consumerism-struck. Can Indians keep their heads above water in their L’affaire with consumerism?

The Reserve Bank of India in its latest report on Household finance reported a rise in household debt in India since 2022. The report has estimated the Household debt at a whopping 42.9% of GDP. The report also flags that number of household borrowers has grown over the years in the country.

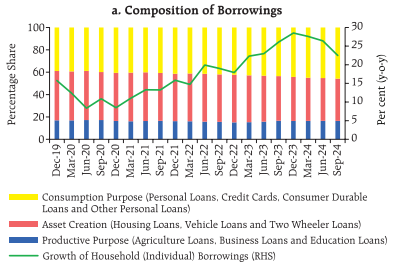

The RBI report is outlining the spike in personal loan segment of the Indian population. The central bank report is pointing at the rising loans for personal consumption like two wheelers, 4-wheelers and other consumer durables like ACs, Refrigerators, LED screens et al.

CONSUMERISM RISING BIG

A glance at the RBI data shows the mindset of the population in India. The RBI analysis finds the following trends.

PERSONAL LOAN BURDEN

As per the RBI report, borrowing by individuals in the household sector constituted around 91 per cent of the stock of household financial liabilities as at end- March 2024.

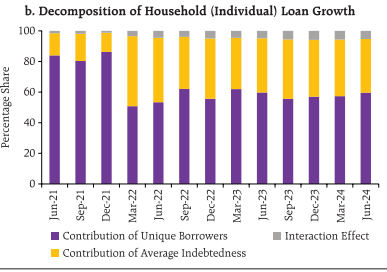

The RBI analysis shows that rise in personal loan has contributed to rise in average indebtedness among the Indian households. The report shows doubling of average indebtedness – from around 15% in June 2021 to around 40% in June 2024.

But the report has flagged an assuring trend.

The RBI analysis, however, found a drop in size of unique borrowers in the rising debt burden of Indian households.

It says, “The rise in indebtedness is not due to individuals borrowers having more than one personal loan portfolio. During Covid period, individual borrowers with multiple loan portfolios stood at a massive 80%. But in 2024, the proportion was down at around 50%.

(See the image above).

WILL HOUSEHOLDS SUCKED INTO DEBT TRAP?

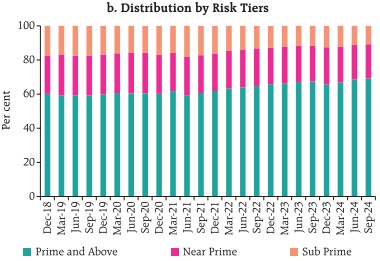

The Central bank of India in its credit risk analysis of individual household borrowers in the country has found the following trends.

TOP 16 STATES IN PERSONAL LOANS

Here is the list of top states where individual households' high personal loan burden is high. Odisha figures at 16 th place among 37 states and UTs in the country.

TRACK THE GROWTH IN ODISHA

See the table below.

2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

18,700cr | 21,300cr | 24,600cr | 29,600cr | 33,897cr | 39,791cr | 47,767cr | 57,644cr | 70,145cr | 85,791cr |

In the last 10-years, the personal loan amount taken by individual household borrowers in the State have gone up by 347%.

The State’s growth in personal loan segment by individual households has been on par with the national trend. Data given above shows in tandem with national growth in year 2023, Odisha had also recorded sharp growth in personal loans in year 2023.