Bhubaneswar: The country will be celebrating International Women’s day on Saturday. Since women form half of the country’s population, a healthy contribution to the country’s economy from half of the population will not only empower them but also accelerate the economic growth of the country, making it gender neutral, too.

In the above backdrop, Niti Aayog has released a report titled “From Borrowers to Builders: Women’s Role In India’s Financial growth Story.”

A glance at the report highlights the following.

However, the strategy of Modi govt’s programmes to accelerate financial access to women is revolutionising. The paradigm shift measured is detailed below.

WOMEN ENTREPRENEURSHIP ON RISE

India is witnessing a rise in Women Entrepreneurs (WEs).

The report shows 16% of women borrowers holding a loan to finance business needs in their portfolio as of December 2024, compared to just 9% in December 2019.

The Niti Aayog report says that over the past 7 years, the Female Labour Force Participation Rate (FLFPR) has steadily increased from 23.3% in 2017-18 to 41.7% in 2023-24.

This growth has been largely fueled by the increased economic participation of rural women.

The report has cited the following evidences supporting a rise in women entrepreneurs

URBAN WOMEN TAKE LOANS FOR PERSONAL FINANCE

As per the data shared by the Niti Aayog, Young women (<=30 years of age) are availing credit for personal finance purposes.

The share of young women in other credit products remained low for originations in 2024.

SEMI-URBAN, RURAL WOMEN TAKE LOAN TO BECOME ENTREPRENEUR

As per the Niti Aayog report,in rural and semi-Urban centres, young women take loans for becoming an emtrepreneur.

The Niti data shows loans to women in semi-urban and rural areas are higher for agriculture, business purposes, and gold than for personal finance loans.

WOMEN TAKE HIGH CONSUMPTION LOAN

For women borrowers in India, consumption loans (i.e. personal loans, credit cards and consumer durable loans) remain the most preferred credit product.

ODISHA WOMEN NOT RANK HIGH IN FINANCIAL EMPOWERMENT

In the indicator of financial empowerment and growth of entrepreneurship, the Niti Aayog report has estimated the growth in women borrowers state wise. Odisha fails to figure in the high list.

STATES | OVERALL LOAN GROWTH (5yrs CAGR) | GROWTH OF WOMEN (5yrs CAGR) | WOMEN SHARE (2024) |

UTTAR PRADESH | 16% | 20% | 23% |

MAHARASHTRA | 9% | 13% | 30% |

TAMIL NADU | 8% | 10% | 44% |

KARNATAKA | 12% | 16% | 34% |

ANDHRA PRADESH | 10% | 13% | 41% |

RAJASTHAN | 14% | 20% | 26% |

MADHYA PRADESH | 15% | 19% | 25% |

Tamil Nadu is the State where share of women borrowers is as high as 44%.

WOMEN CIBIL SHOW

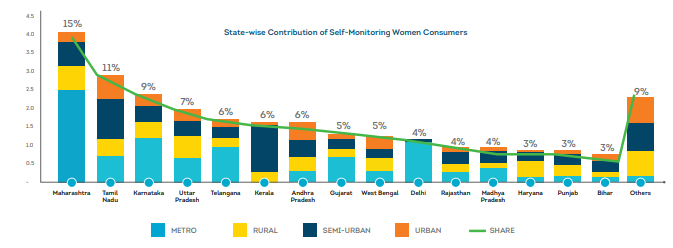

The Niti report has brought to fore that women are increasingly demonstrating financial independence through self-monitoring and credit management.

It says, “This is a testament to their growing financial acumen. Women take charge of their financial futures.”

STATE WISE SHOW