Stronger inspections and faster hiring will improve national food quality

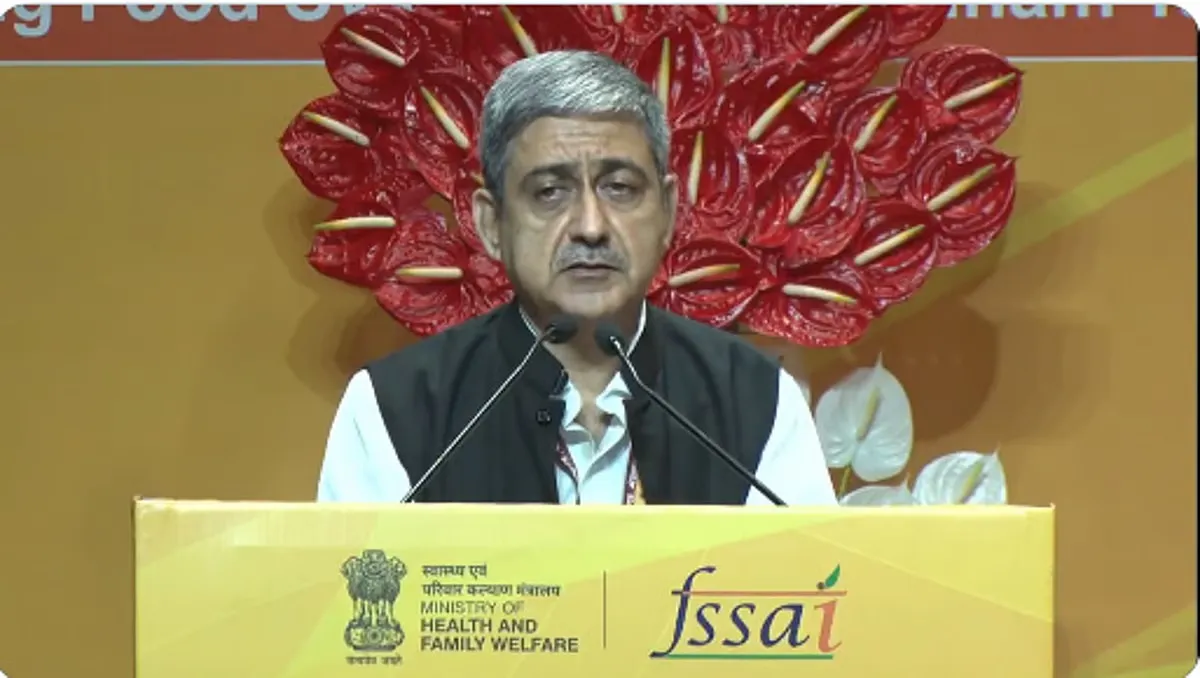

Ensuring the health of citizens is becoming a top priority for national regulators. During the 49th Central Advisory Committee (CAC) gathering in Gangtok, Sikkim, the Chief Executive Officer of the Food Safety and Standards Authority of India (FSSAI), Rajit Punhani, issued a stern directive to all states and Union Territories. He pointed out that local authorities must drastically improve their FSSAI food safety enforcement strategies to protect the public from substandard products.

Authorities are now tasked with keeping a closer watch on specific items that frequently face adulteration. This includes essential household goods like milk, edible oils, honey, and various spices. Punhani highlighted that risk-based inspections should be the standard approach, ensuring that high-risk food commodities undergo rigorous testing. By conducting consistent surveillance drives, the government aims to catch non-compliant Food Business Operators who ignore health regulations.

Effective oversight is only possible with a full team of experts on the ground. The CEO urged state leaders to speed up the hiring process for food safety officer recruitment. Currently, many technical positions remain empty, which weakens the ability of states to monitor local markets. Filling these gaps is essential for the proper implementation of the Food Safety and Standards Act and for maintaining a visible presence in every district.

Public confidence relies heavily on how quickly the government reacts to concerns. Punhani directed officials to create better systems for consumer grievance redressal, ensuring that complaints are resolved within a specific timeframe. Transparency is key; when the FSSAI takes action against a violator, those results should be shared with the public. This open communication proves that the regulatory body is held accountable and is actively working to keep food supplies "safe and wholesome."

Future efforts will involve better data sharing between the central FSSAI office and state authorities. By leveraging centralized surveillance systems, the organization can identify national trends in food contamination more accurately. This data-driven strategy, combined with easier licensing processes, will help honest businesses comply while making it harder for violators to operate undetected.