New Delhi, September 22: Union Minister Ashwini Vaishnaw has strongly criticized Opposition parties for attacking the Goods and Services Tax (GST) reforms, which are set to take effect on Monday. Drawing a stark contrast between the tax burden on common goods during the United Progressive Alliance (UPA) era and the current GST framework, Vaishnaw accused the previous government of subjecting industries and MSMEs to "tax terror" before 2014.

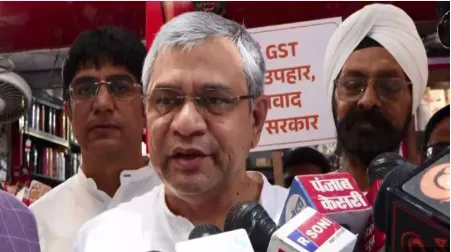

During a press conference in the national capital, Vaishnaw shared an optimistic view of the reforms, stating, "The GST reforms have been rolled out today. Just earlier, I visited a market in RK Puram, and people there were happy with the changes." He added that before the GST came into effect, industries and MSMEs were caught in a maze of complex taxes. "The UPA regime imposed a web of taxes that affected industries and MSMEs. GST unified them into a single tax structure. Once GST gained acceptance, we began implementing next-generation reforms. Step by step, we’ve put the nation on a positive trajectory. I thank Prime Minister Modi and Finance Minister for their leadership in these reforms."

Vaishnaw also pointed to the significant reductions in tax rates for household goods and other essential items. Under the UPA, cement was taxed at 30%, while it is now taxed at 18%. Sanitary pads were taxed at 13% but are now free from tax, and footwear saw a drop in tax from 18% to 5%. "The Opposition is unhappy because their time was filled with empty rhetoric and no action. Under UPA, cement was taxed at 30%, making it difficult for a common man to build a house. Now, it’s at 18%. Sanitary pads were taxed at 13%, and now they are zero-rated. Paint, which was taxed at 30%, is now taxed at 18%. Footwear, once taxed at 18%, now has a 5% tax," Vaishnaw explained.

He also clarified that common household items like refrigerators and televisions should not be considered luxury goods. "Under the UPA, a refrigerator was taxed at 30%, and now it's reduced to 18%. Likewise, the tax on detergent and shampoo, which was 30%, is now just 5%, and the tax on coffee has dropped from 30% to 5% as well," Vaishnaw added. He also highlighted the reduction in fertilizer and urea taxes for farmers, which had been 12% under the UPA and are now taxed at just 5%.

These remarks from Vaishnaw came after the Opposition ramped up its criticism of the new GST reforms. Congress leader Jairam Ramesh accused Prime Minister Narendra Modi of a U-turn on GST, recalling that Modi had opposed the tax when he was the Chief Minister of Gujarat. "From 2006 to 2014, only one CM opposed GST, and that CM became the Prime Minister in 2014 and reversed his stance, positioning himself as the champion of GST in 2017," Ramesh said.

Ramesh further claimed that the recent GST reforms were inadequate in addressing the procedural challenges faced by MSMEs. "The GST reforms are limited and don't simplify the complexities MSMEs face. The Prime Minister has yet to address the demand from state governments for a five-year compensation package," he added.

Meanwhile, Congress MP Pramod Tiwari accused the government of exploiting the poor and middle-class citizens. "Who increased the GST for eight years? It was under this government. Instead of apologizing, PM Modi should address the burdens he has placed on the people of this country," Tiwari remarked.

As the GST reforms are set to transform the nation's tax landscape, the debate between the government and Opposition continues to intensify.