Politics

Rahul Gandhi to visit Odisha on July 11, says...

July 01, 2025

Odisha Govt sends special health teams to tack...

Odisha: Two more arrested in BMC officer assau...

Technology

"Applied for data entry job, learned AI does...

June 25, 2025

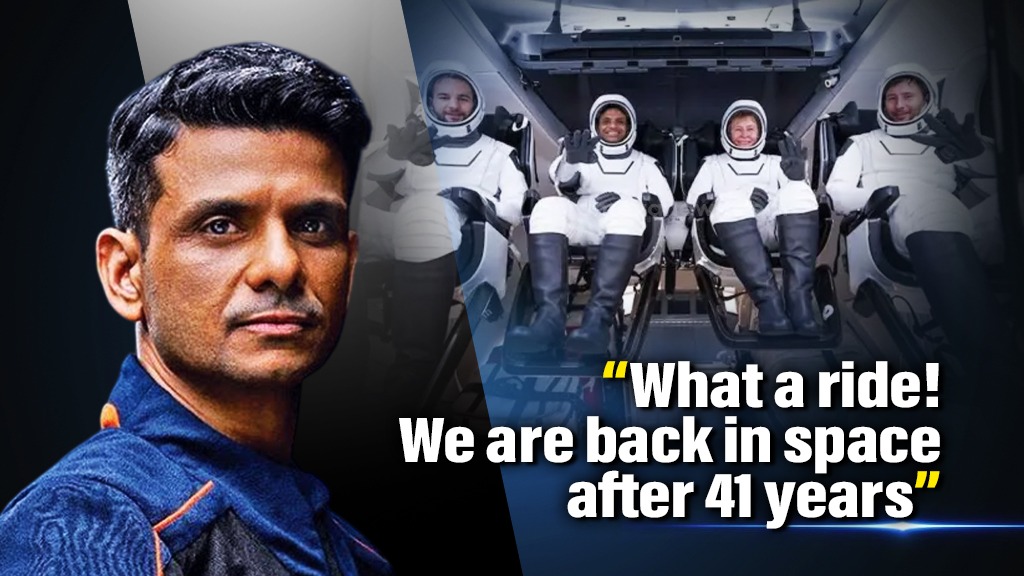

“We Are Back in Space”: Indian Astronaut Shubh...

Google launches advanced AI mode in India to e...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.