Bhubaneswar: Finance Minister Nirmala Sitharaman ushered in the goddess of prosperity ‘Mahalakhsmi’, as hinted by PM Narendra Modi Friday, by proposing an increased income tax rebate for personal income tax upto Rs 12 lakh per annum.

A glance at the Budget fine print brings to fore how the FM has waved her magical wand on the personal income tax payers to boost consumption of the consuming class.

As per the Budget document,

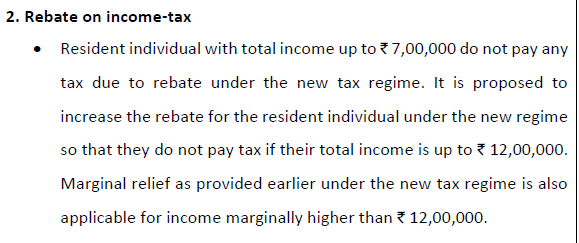

WHAT IS REBATE ON INCOME TAX?

This is a tax relief provided to individuals, especially those in the lower-income bracket to ensure that they are not burdened with income tax if their income is below a certain threshold.

As on March end 2025, under the new tax regime, a tax rebate is available on income up to Rs. 7 lakh and up to Rs. 5 lakh under the old regime.

In the Budget 2025-26, the Finance Minister has raised the limit under this section to Rs 12 lakh.

WHO ARE ELIGIBLE UNDER REBATE ON INCOME TAX?

This rebate is not applicable to Hindu undivided families, corporate and firms.

(See the image below.)

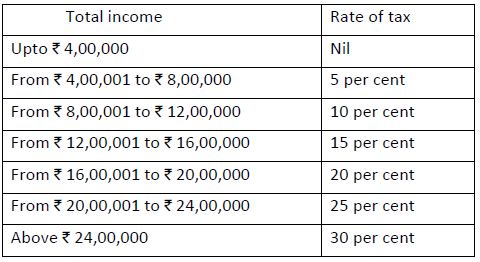

HOW PERSONAL TAX ASSESSED?

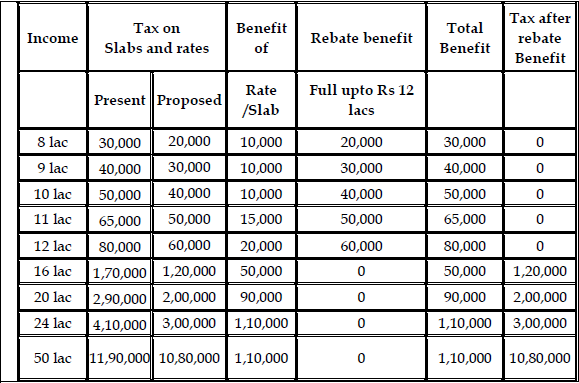

Here is an illustration.

HOW THIS OPERATIONALISE?

In the current Budget 2025-26, the FM has raised the threshold limit to avail the rebate to Rs 12 lakh from 7 lakh last year.

So, if the income of an individual exceeds Rs 12,00,000 and tax payable on such income is exceeding the income amount over and above Rs.12,00,000, then the tax will be limited to the extent of such income exceeding Rs. 12 lakhs.

Step I – Calculate excess above Rs.12 lakhs Total income (A)

Step II - Compute income-tax liability on total income (B)

Step III – if B>A, rebate under section 87A would be (B-A).

LIVE EXAMPLE

HOW THE REBATE CALCULATED?

More over, as the FM has effected rationalisation uo tax rates under various tax slabs, she has present how it boils to individuals with different incomes. The illustration the FM given is presented below.