Politics

Lalu Prasad Yadav re-elected as RJD President...

July 05, 2025

BJD leader Lekhashree files complaint against...

Odisha CM’s public grievance hearing to be hel...

Technology

Bhubaneswar Hosts Major GenAI Workshop with In...

July 04, 2025

"Applied for data entry job, learned AI does...

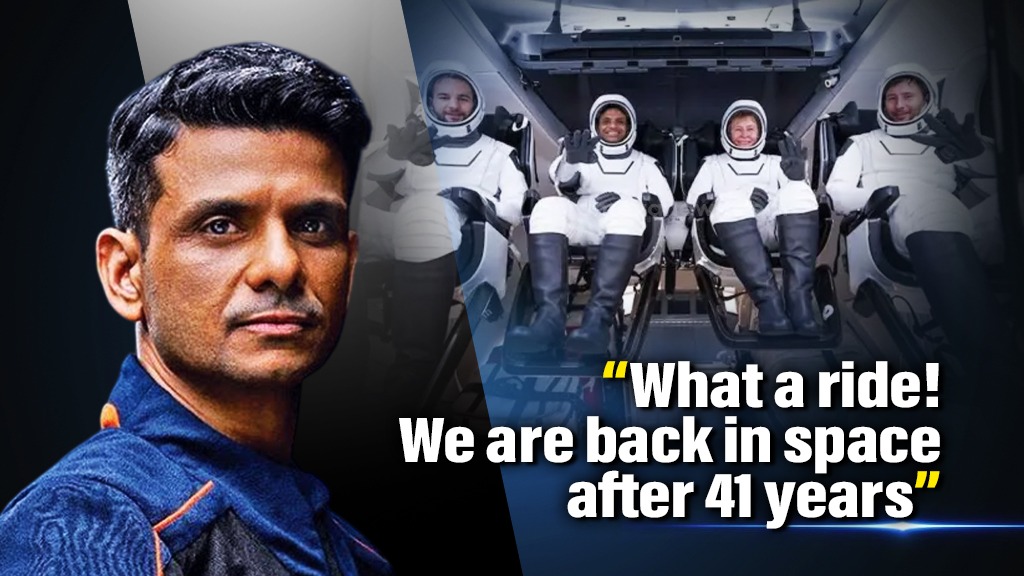

“We Are Back in Space”: Indian Astronaut Shubh...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.