Taxation of Interest Income from Bank Deposits

Taxation of interest income should be abolished. There is no publicly available data as to the quantum of tax collection on this head, cost incurred thereto and net inflows. Dr Manas R Das Adam Smith, the Father of Economics and author of The Wealth of Nations propounded four “canons” of taxation. These are: Ø Equality meaning tax payments should be proportional to income. Ø Certainty meaning tax liabilities should be clear and certain. Ø Convenience of payment meaning taxes should be collected at a time and in a manner convenient for taxpayer. Ø Economy of collection meaning taxes should not be expensive to collect and should not discourage business. IT Rules for Interest Income According to the extant IT rules, interest earned from bank deposits is treated as income and therefore liable for income tax. As for savings bank accounts, interest earned beyond Rs.10,000 during a Financial Year (FY) is taxable. Interest earned on fixed deposits and recurring deposits is fully taxable; it is added to the taxpayer’s income and taxed according to the tax slab she falls in. Besides, banks are allowed to deduct tax at source from the interest subject to certain conditions. Canon of Equality Predominantly, the “fixed income earners” starting from factory workers to government employees to retired people save in banks. The “fixed income earners” represent the wide spectrum of ‘middle class’households which represents huge ‘demand’ and keeps the wheels of the economy running.Thus, India’s savings story is driven by the household sector in the form of bank deposits. In addition, demographic data reveal that people’s longevity has become longer thanks to rising standard of living. However, several factors have made the old age a painful phenomenon for the middle class. These include, inter alia, (a) high cost of living, (b) inadequate social security schemes, and (c)due to high unemployment many are required to support their children even after retirement. Therefore, taxation of interest income does not quite satisfy the principle of equality. The principle of equality gains added significance when inflation erodes interest income. Notably, for the middle class, the propensity to consume is high, and today, rates of interest offered by banks are too meagre to yield an adequate positive ‘real’ return on deposits. Thus, the tax exacerbates the middle class’s owes of low ‘real’ return on bank deposits. Canon of Certainty No doubt, the IT rules have over time become less ambiguous and more transparent, and the procedures simpler too. However, as far as taxing interest income is concerned, two ambiguities remain. First, the interest earned in a FY,besides being taxed in that year, is added to the account holder’s deposits under the compound interest rate regime and becomes again liable for taxation in the subsequent years. Second, interest earned is taken for taxation on accrual basis, not on realization basis, i.e., depositors do not withdraw the interest accrued for current consumption except in the case of Monthly Income Schemes or premature closure of the account. Moreover, despite significant improvements over time, it still takes a fairly long time to get refund from the IT Department if the bank deducts more tax at source, and in the meantime, the depositor suffers opportunity loss. Canon of Convenience of Payment Even though the government finds it difficult to do away with the tax on interest income,it should not be collected at economically hard times;during the 2008-09 economic slowdown and Covid-19, the tax remained. Absence of ‘accommodations’ during such times may instigate tax evasion. Further, it is peculiar that, so long as one is in employment, her Provident Fund contributions, along with interest thereon (mostly), are tax-free, whereas the day after her retirement when she puts her retirement benefits in a bank, interest thereon gets taxed! Actually, in the post-retirement period, she would need that money much more than ever. Canon of Economy of Collection Mechanization at banks as well as the IT department has reduced, though not eliminated, the workforce engaged in the related activities, and thereby the related cost. However, procurement of machines, and their regular maintenance and upgradation does entail cost. And, machines do require manning. Against this backdrop, we wonder whether it is economical for the IT Department to collect this tax. Conclusion In view of the above, it is opined that taxation of interest income should be abolished. There is no publicly available data as to the quantum of tax collection on this head, cost incurred thereto and net inflows. About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

Odisha govt to refund 5 lakh chit fund victims...

ISKCON Hails Gautam Adani's Humble Service at...

Odisha: BMC Additional Commissioner Ratnakar S...

Similipal Tigress Zeenat, who roamed 3 states,...

Train services disrupted due to landslide on K...

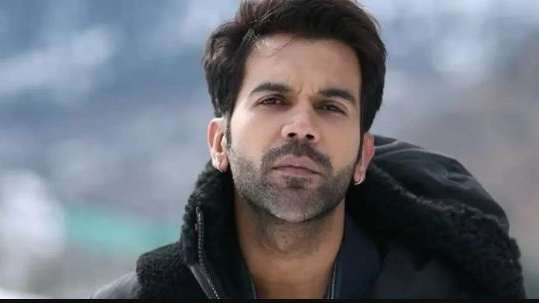

Rajkummar Rao to play Sourav Ganguly in upcomi...

SOA Vice-President stresses need to empower nu...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.