Politics

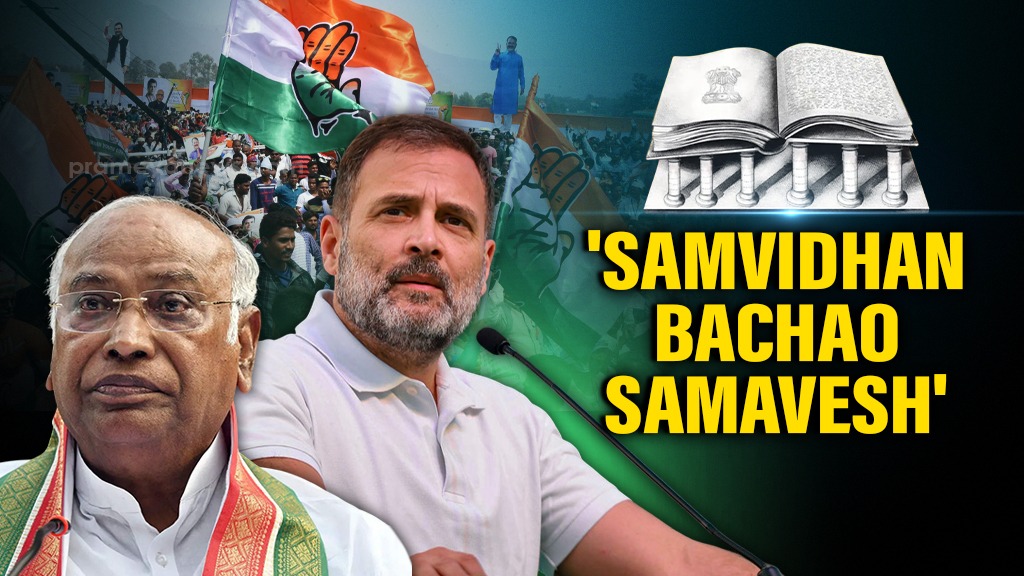

"Rahul Gandhi should have apologised to Odias"...

July 12, 2025

Naveen Patnaik returns to Bhubaneswar after su...

Pradhan calls Rahul Gandhi's Odisha rally 'pol...

Technology

Apple Accelerates China Exit Strategy as Foxco...

July 12, 2025

Su-30MKI Successfully Tests 'Astra' Missile wi...

Final Countdown: Axiom Mission 4 Crews are wra...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.