The Anatomy of a Landmark Digital Heist

In a case that exposes the devastating psychological power of modern cybercrime, a 78-year-old retired banker from New Delhi was coerced into transferring his life savings, a staggering ₹22.92 crore, to fraudsters over a harrowing six-week period. This incident stands as one of the largest single-victim frauds of its kind in the nation's capital, revealing a meticulously planned operation that left behind a complex and bewildering financial trail.

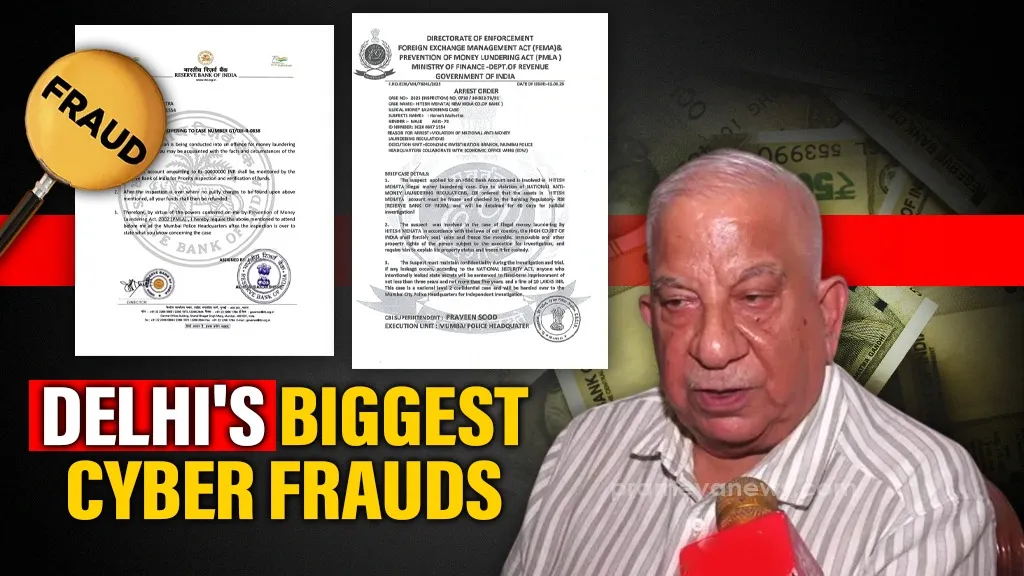

Elaborate Deception

The ordeal began on August 1, when the victim, Naresh Malhotra, received a call from individuals impersonating high-ranking officials from the Enforcement Directorate and the Mumbai Police. They informed him that his identity had been compromised and was being used in a major criminal case involving terror-funding and money laundering. To avoid immediate arrest and prove his innocence, he was told he must cooperate fully and transfer his funds into designated accounts as a form of surety. The criminals assured him the money would be verified and returned by the Reserve Bank of India and the Supreme Court once he was cleared.

Under Digital Siege

Under this constant threat, Mr. Malhotra fell into a state of complete psychological capture. For over a month, he lived under the remote command of the scammers, who had taken over every aspect of his life. He was isolated from his family, keeping the entire situation a secret while maintaining his daily routines to avoid suspicion. The control was so absolute that he had to seek permission from the fraudsters even to withdraw small amounts of his own money to pay his staff's monthly salaries. He later described the experience as feeling "possessed," with his critical thinking faculties entirely overridden by the perpetrators' instructions.

Unwitting Transfers

Between early August and mid-September, Mr. Malhotra made 21 separate visits to three of his banks, all located near his South Delhi home. He personally authorised 21 large Real-Time Gross Settlement (RTGS) transfers to 16 different accounts spread across the country, from Uttarakhand to Tamil Nadu. Bank staff raised no alarms. To them, he was a familiar and respected client calmly conducting his business, sometimes even sharing a cup of tea while the transactions were processed. His composed demeanour, a front he maintained under duress, effectively masked the intense coercion he was experiencing.

Vanishing into the Digital Haze

The stolen funds were immediately laundered through an intricate web of transactions designed to obscure their origin. The initial ₹22.92 crore was splintered into more than 4,236 smaller transactions, creating a seven-layer deep maze for investigators. According to the Intelligence Fusion & Strategic Operations (IFSO) Branch of the Delhi Police, this layering technique is a hallmark of sophisticated financial fraud. The delay in reporting the crime—Mr. Malhotra only filed a complaint after the scam ended—meant the critical "golden hour" for freezing the funds was lost, significantly complicating recovery efforts. To date, authorities have managed to freeze only ₹2.67 crore of the stolen amount.

The Breaking Point

The psychological spell was finally broken on September 19. Having already siphoned nearly ₹23 crore, the fraudsters demanded an additional ₹5 crore, instructing him to transfer it to a private company's account in West Bengal. For the first time, Mr. Malhotra resisted. Citing his banking principles, he refused to make a third-party transfer, instead offering to deposit the sum directly with the Registrar of the Supreme Court. The scammers responded with threats of immediate arrest. In a moment of defiance, he told them to proceed and arrest him. They promptly disconnected the call, and the six-week nightmare was over. The subsequent investigation has revealed a sprawling criminal network, highlighting the urgent need for greater public awareness of these psychologically manipulative digital threats.

Essential Briefing Points

Massive Financial Loss: A 78-year-old retired banker was defrauded of ₹22.92 crore, marking one of Delhi's largest "digital arrest" scams targeting an individual.

Profound Psychological Manipulation: The victim was held in a state of "digital arrest" for six weeks by scammers impersonating law enforcement, who controlled his actions and finances completely.

Sophisticated Money Laundering: The stolen money was laundered through a complex, seven-layer system involving over 4,236 transactions across 16 bank accounts nationwide, making recovery extremely difficult for authorities.

The Crucial Role of Victim Defiance: The elaborate scam only ended when the victim, pushed to his limit by a final demand, defied the fraudsters' instructions, breaking their psychological hold over him.