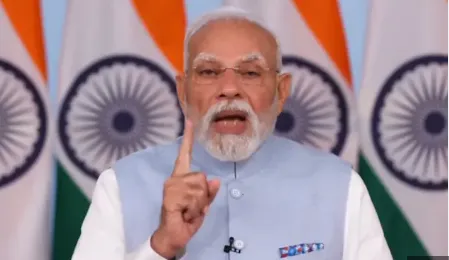

New Delhi, September 21: Prime Minister Narendra Modi announced that significant reforms to India’s Goods and Services Tax (GST) will come into effect from the morning of September 22, marking the start of a new chapter in the country’s tax structure. This momentous change, coinciding with the first day of Navratri, was hailed by the Prime Minister as a crucial step towards realizing the vision of an Aatmanirbhar Bharat.

In his national address on Sunday evening, PM Modi said, “From sunrise on September 22, a new chapter in India’s tax regime will begin,” describing the implementation of the next-generation GST reforms as the launch of a “GST Savings Festival.” He emphasized that these reforms would have a direct and positive impact on various segments of society, including the poor, middle class, women, small businesses, and youth.

“These reforms will lead to greater savings for every Indian. People will be able to purchase their preferred goods with greater ease. This festive season, happiness will multiply for all,” he added. The Prime Minister also expressed confidence that the new GST structure would accelerate India’s economic growth.

Reflecting on the evolution of GST, PM Modi took a moment to recall the complexities of India’s tax system before 2017, when it was burdened by various taxes such as excise, VAT, and octroi. He highlighted how traders and citizens were caught in a web of multiple taxes, and the movement of goods across cities meant dealing with several checkpoints, endless paperwork, and arbitrary tolls—ultimately raising the cost for the consumer.

Quoting an example, the Prime Minister pointed out how, in 2014, a foreign newspaper had reported that a company found it easier to ship goods from Bengaluru to Europe and then back to Hyderabad than to send them directly between two Indian cities, owing to the convoluted tax system in place at the time.

PM Modi credited the GST reform, which was introduced in 2017 following extensive discussions with states and stakeholders, as a historic move that freed India from such inefficiencies. “The successful realization of ‘One Nation, One Tax’ was made possible through the collective efforts of both the Centre and states,” he remarked.

Looking ahead, the Prime Minister stressed that reforms must evolve to meet changing times. The next-generation GST reforms, he said, are designed to simplify processes, reduce costs, and empower all sections of society. “Reform is an ongoing process. As time progresses, so must our systems. Tomorrow marks the beginning of a new era,” he concluded.