CGST Bhiwandi Commissionerate arrests businessman for running fake ITC network

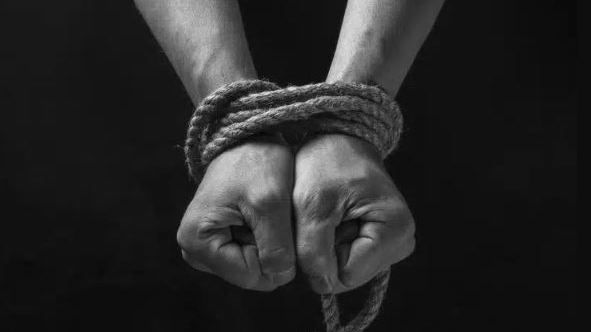

New Delhi,Jan 22: The officers of Bhiwandi Commissionerate of CGST Mumbai Zone have arrested a businessman was running a Fake GST Input Tax Credit racket.Acting on an intelligence from Central Intelligence Unit of Mumbai CGST Zone, the officers initiated coordinated action at different locations in Thane, Bhiwandi, Raigad and Mumbai and detected GST evasion of Rs 11.4 crore through generation and passing of fake ITC through intricate web of bogus billing of more than 63 Crores.The search was conducted at Bhiwandi based business premises of M/s. Adarsh Scrap Traders which was indulging in bogus billing and availment and passing on of fake ITC and thus defrauding the Government exchequer of its rightful GST revenue. The initial investigation revealed that firm had fraudulently claimed and passed on Input Tax Credit (ITC) of Rs11.4 Crores without actual supply or receipt of goods. The proprietor of the firm, confessed to the bogus billing and running of fake ITC racket. He was arrested on Friday under Section 69 of CGST Act, 2017 and was produced before the Hon'ble Additional Chief Metropolitan Magistrate, Fort, Mumbai, today. The CMM has remanded the accused to 14 days judicial custody, till February 4.The amount of fake ITC involved is likely to go up during the ongoing investigation once the entire network is investigated. The roots of this network are spread across the cities of Nagpur, Pune, Delhi and Nasik apart from Mumbai and Thane. At this stage, it seems that around 25 entities are part of this network. Jurisdictional Commissionerates are being informed to initiate legal action against the firms falling in their jurisdiction.This operation is a part of efforts by CGST Mumbai Zone to eradicate fake ITC networks, which have been vitiating the healthy economic ecosystem of the country and defrauding the Government Exchequer. This the Sixth arrest by Bhiwandi Commissionerate in last 6 months. The department will intensify the drive against fake ITC networks and other GST evaders in the coming months.

Latest News

Odisha’s Balasore and Mayurbhanj hit by floods...

Flash floods and landslides ravage Himachal Pr...

Additional coaches in Rajdhani and Rajyarani E...

OAS & ORS Officers go on indefinite mass leave...

The 'Criminal Justice' Finale Hinges on One Th...

Telangana factory blast: Four from Odisha conf...

From Vanishing Tides to Vibrant Art: Why Balas...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.