Bank Branch Expansion in Odisha – II

Manas R. Das At March-end 2021, there were 11.71 branches per lakh of population in Odisha, compared to 7.51 branches per lakh of population in March 2011 Branch Density Branch density is a measure of the adequacy of a branch network. Table 1 presents branch density on the basis of (a) Per lakh of population and (b) Per thousand sq. km. {"align":"center","id":132622,"width":619,"height":191,"sizeSlug":"full","linkDestination":"none"} At March-end 2021, in Odisha, there were 11.71 branches per lakh of the population compared to 7.51 branches per lakh of population in March 2011. Similarly, per thousand sq. km., there were 35.20 branches at March-end 2021 as against 20.26 at March-end 2011. Compared to all-India branch density, Odisha reflected a faster increase during 2011-21. In terms of ‘per lakh of population’, Odisha witnessed an increase of 55.9% as against 44.1% in respect of all-India. In terms of ‘per thousand sq. km.’, the increase in respect of Odisha was 73.7% compared to 66.2% in respect of the country. Economic Status and Branch Network Normally, per capita income indicates a person’s ability to spend and save. For both transaction and saving purposes, especially in modern society, one needs a bank branch. Chart 1 examines the relationship between per capita income (represented by Per Capita Net State Domestic Product - NSDP) and branch network. {"align":"center","id":132623,"sizeSlug":"full","linkDestination":"none"} Since per capita income is the primary determinant of people’s propensity to save, it also determines the potential of banks to do business. As can be seen from the chart, in Odisha, these two variables are strongly, positively correlated (Correlation Coefficient = +0.912). As per capita income increased, the number of branches also increased. However, the pace of increase in branches seemed sluggish in comparison to that in per capita income. Between 2011-12 and 2019-20, while the per capita income multiplied 2.20 times, the number of branches multiplied 1.56 times. Individual Bank Branches As of March-end 2021, in terms of the number of branches, the top three Public Sector Banks (PSBs) in the State were: State Bank of India, Punjab National Bank, and Union Bank of India (in that order) which together commanded 55% of the total PSB branches. State Bank of India was at the top with a 31% share. Among the private sector banks (excluding Small Finance Banks and Payment Banks), the top four banks in the State were: Bandhan Bank, Axis Bank, HDFC Bank, and ICICI Bank (in that order) which together accounted for 72% of the total private bank branches. Bandhan Bank was at the top with a 20% share. Concluding Remarks To sum up, the banking network in Odisha expanded over time, by and large, in tandem with the national trend. The private banks, especially the new ones have shown immense interest in the State to do business. Increasing per capita income is both intrinsic and instrumental to the expansion of the banking network, and here the government’s role emerges as important. Banking habits need to be inculcated among the unbanked and under-banked people. Diffusion of banking facilities through either electronic channels or brick-and-mortar branches has to be made. A solid bank branch network will preclude unauthorized channels and the attendant collateral damage inflicted on everyone – people and institutions alike. About the Author: Dr. Manas R. Das is a former senior economist of the State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medalist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of the Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

UK Regulator Flagged Boeing 787 Fuel Switches...

Jaishankar Meets Xi Jinping in First Major Tal...

After Balasore outrage, Another shock as teach...

FM College student’s death: Odisha CM Mohan Ma...

"Non-Veg Milk" Stalemate: How Cultural Beliefs...

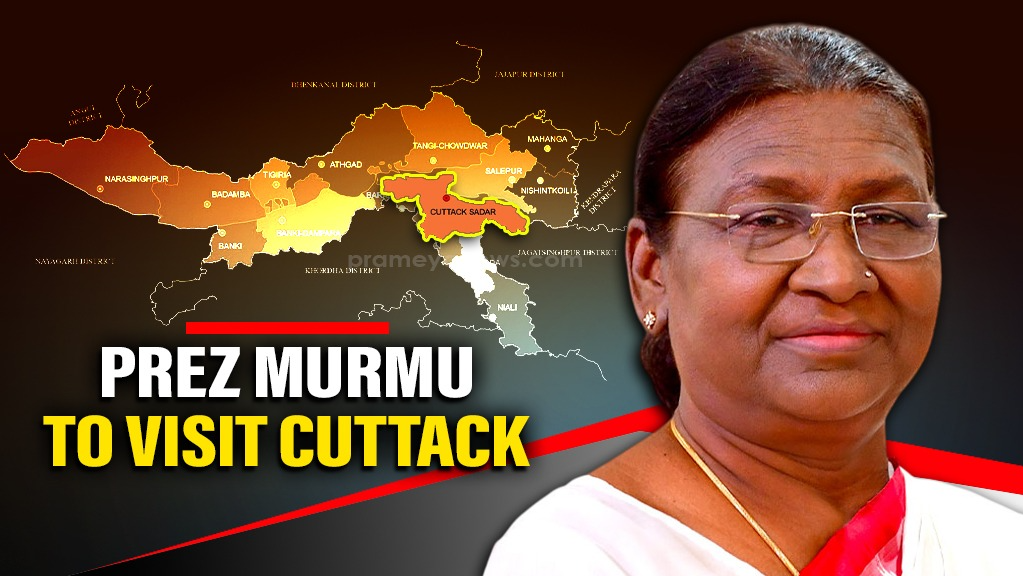

Prez Droupadi Murmu to attend four key events...

FM College student’s death casts pall of gloom...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.