Politics

Odisha: Expelled Congress leader Sura Routray’...

April 25, 2024

Shah gives ‘guru mantra’ to party leaders ahea...

Hockey Star Prabodh Tirkey joins BJP

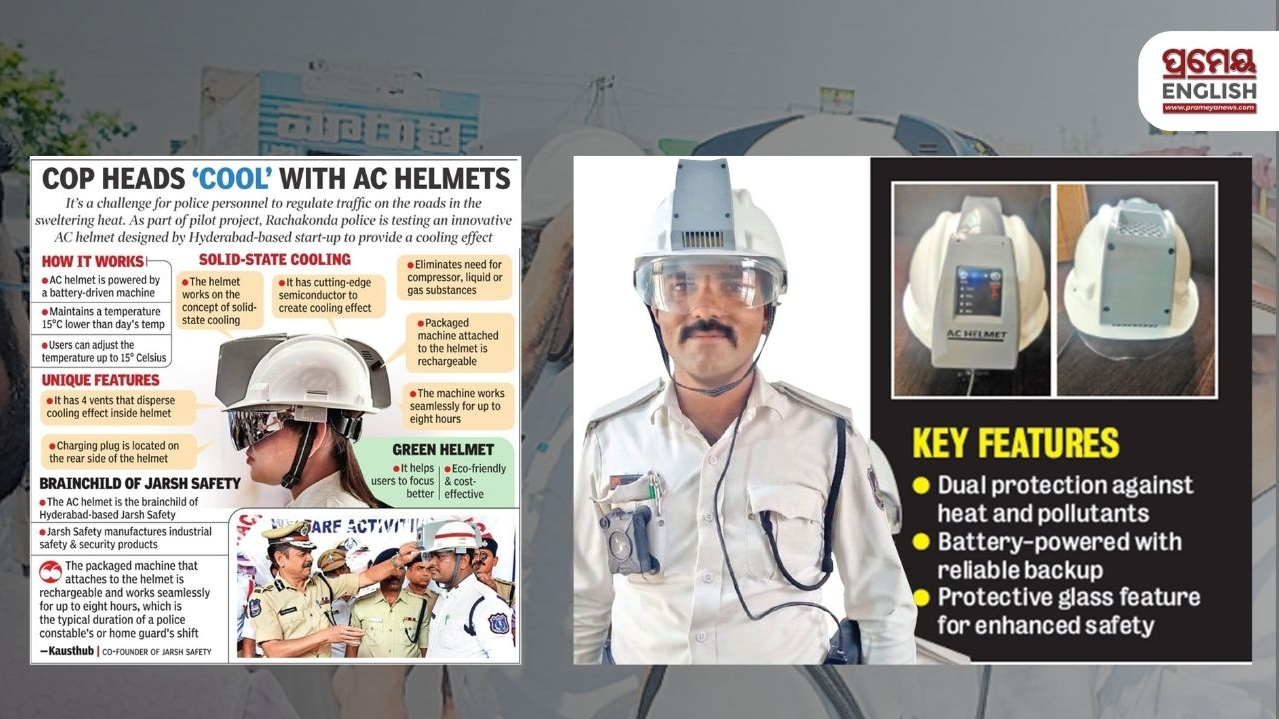

Technology

Innovative AC Helmets Developed by IIM Student...

April 25, 2024

UiPath launches two new data centres in India

India carries out successful launch of medium-...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.