How America Banks

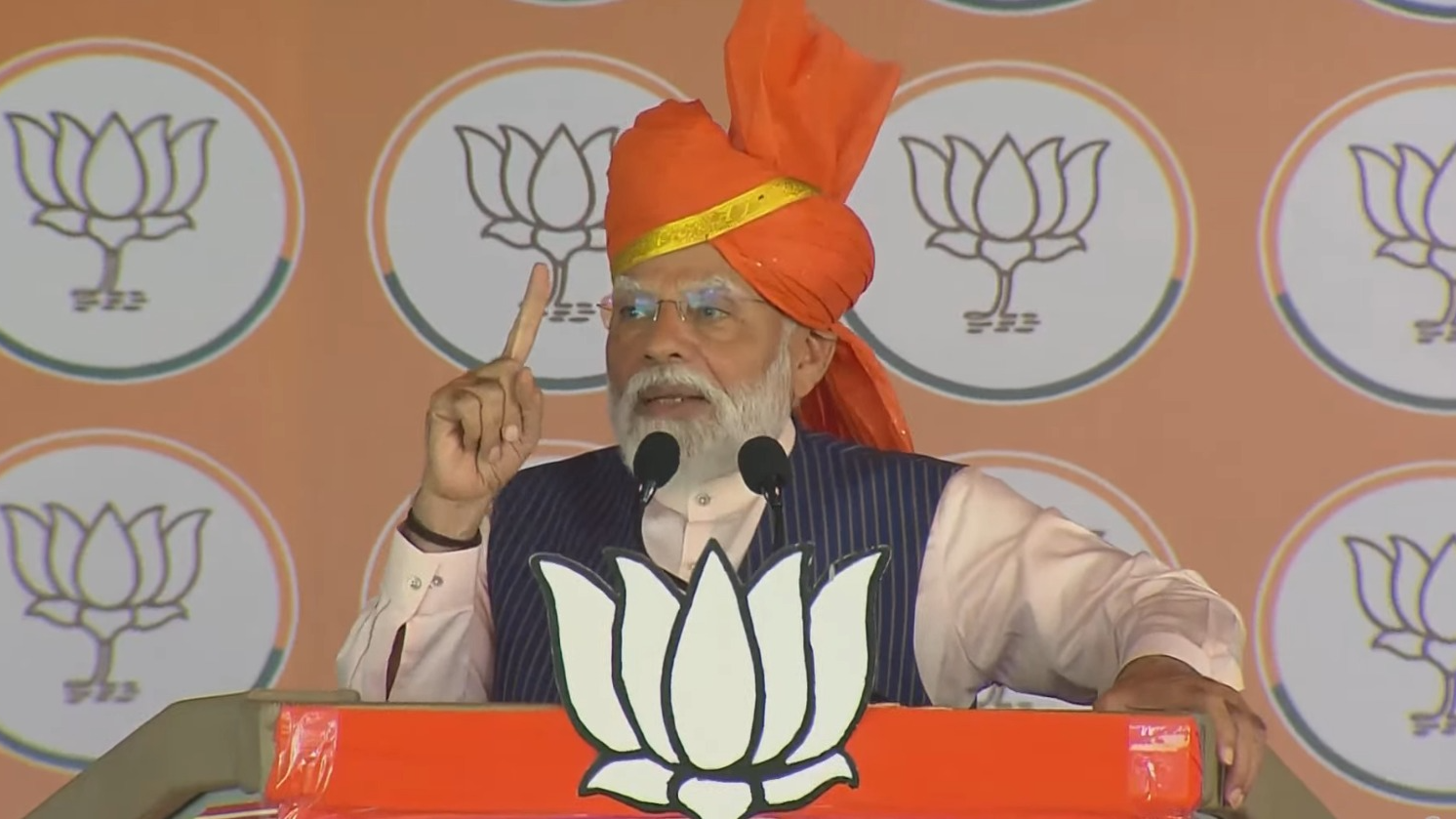

The US being a developed economy, the incidence of financial exclusion is very low. Moreover, modern methods of banking such as mobile banking are not only high but also increasing rapidly. However, it hasn't made branch visits by consumers redundant. In other words, branches continue to be relevant. Manas R Das This article presents the salient findings of the FDIC Survey of Household Use of Banking and Financial Services. The biennial survey, which started in 2009, is conducted in collaboration with the US Census Bureau. The survey estimates the banked and unbanked population in the US and studies use of banking and financial products and services by households. It is the most comprehensive analysis of its kind. The most recent survey, conducted in June 2019, collected responses from nearly 33,000 households. Unbanked Households wp:list One hundred twenty-four million or 94.6% of US households had at least one bank or credit union account in 2019, while 5.4% (7.1 million) of households did not, the lowest since the survey began in 2009. /wp:list {"id":83601,"width":554,"height":326,"sizeSlug":"large"} wp:list The number and proportion of all unbanked households fell during 2017-19. Improvements in the socioeconomic conditions of the households significantly influenced the decline.Unbanked rates were higher among lower-income households, less-educated households, working-age disabled households and households with volatile income.In 2019, 8.1% of urban households were unbanked, as against 6.2% of rural households and 3.7% of suburban households.Among unbanked households in 2019, half were previously banking. The proportion was marginally higher than that in previous years.Among unbanked households in 2019, 56.2% were not at all interested in having a bank account, while 24.8% were very or somewhat interested.Lack of adequate money to meet minimum balance requirements was the main cause for not having a bank account by unbanked households. This was followed by lack of trust on banks.Nearly 28% of unbanked households used prepaid cards in 2019, much above that for banked households. /wp:list Banked Households wp:list Mobile banking emerged as the most popular primary mode to access account. The proportion of banked households using mobile banking to access their accounts (in the past 12 months) witnessed a continuous uptrend from 9.5% in 2015 and 15.6% in 2017 to 34.0% in 2019. It surpassed online banking as the most prevalent primary mode.Online banking, though continued to prevail, lost some of its shine as a primary method of account access. The proportion of banked households using online banking fell sharply from 36.9% in 2015 and 36.0% in 2017 to 22.8% in 2019.Use of bank tellers, though remained prevalent (2019 – 21.0%), continued to decline; however, the decline was moderate compared to the decline in use of online banking. /wp:list Table 1: Primary Method Used to Access Bank Account by Banked Households* wp:table Mode201520172019Bank Teller28.2%24.3%21.0%ATM/Kiosk21.0%19.9%19.5%Telephone Banking3.0%2.9%2.4%Online Banking36.9%36.0%22.8%Mobile Banking9.5%15.6%34.0%Others0.9%0.7%0.3% /wp:table * That accessed their account in the past 12 months wp:list In 2019, 83.0% of banked households visited a bank branch in the past 12 months, down marginally from 2017.Older households and households with volatile income were more likely to visit a branch and to visit ten or more times.Even banked households that used online or mobile banking as their primary method of account access visited branches.Some consumers, both banked and unbanked, used general purpose reloadable prepaid cards to conduct financial transactions such as paying bills, withdrawing cash at ATMs, making purchases, depositing checks and receiving direct deposits.In 2019, in aggregate, 17.2% of households used at least one of those three services (money orders, cheque cashing or bill payment services) in the past 12 months. Besides, 5.5% of households used international remittances, and 31.1% used person-to-person payment services. /wp:list {"id":83597,"width":581,"height":349,"sizeSlug":"large"} wp:list In 2019, 72.5% of US households used bank credit, such as a credit card, personal loan, or line of credit from a bank. Use of nonbank credit declined from eight percent in 2015 to nearly five percent in 2019. /wp:list FDIC - Federal Deposit Insurance Corporation (USA) About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

Virat Kohli's statue installed at Jaipur Wax M...

Punjab electoral officer to go Live for electi...

Pranab Prakash Das hits campaign trail in Angu...

Jilted lover stabs corporator's daughter to de...

Nestle baby food sugar study causes concern in...

'Yamraj' files nomination as Independent for M...

ED reveals Kejriwal's high glycaemic index die...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.