Contraction in economic activities well expected post Covid shutdowns

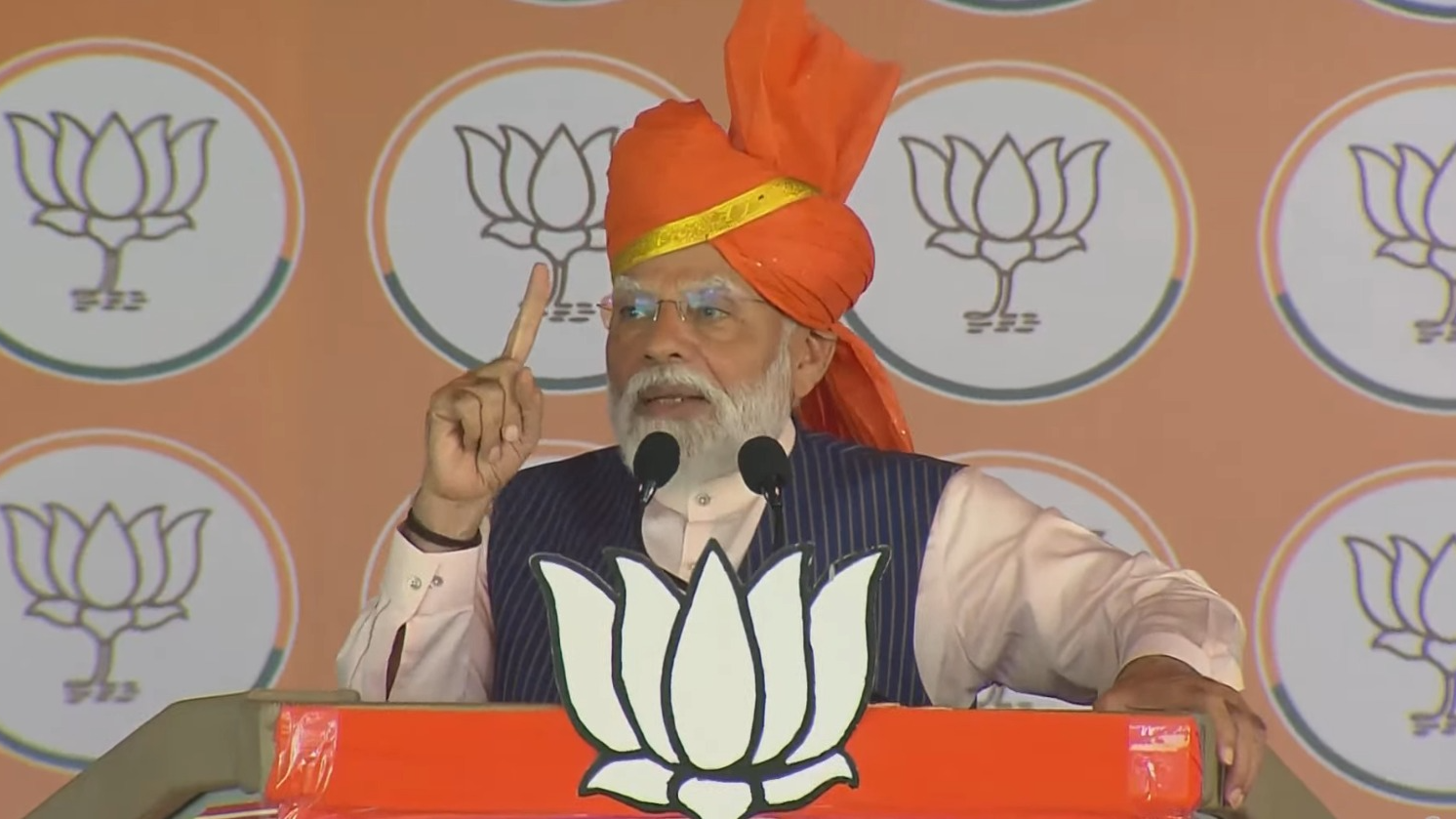

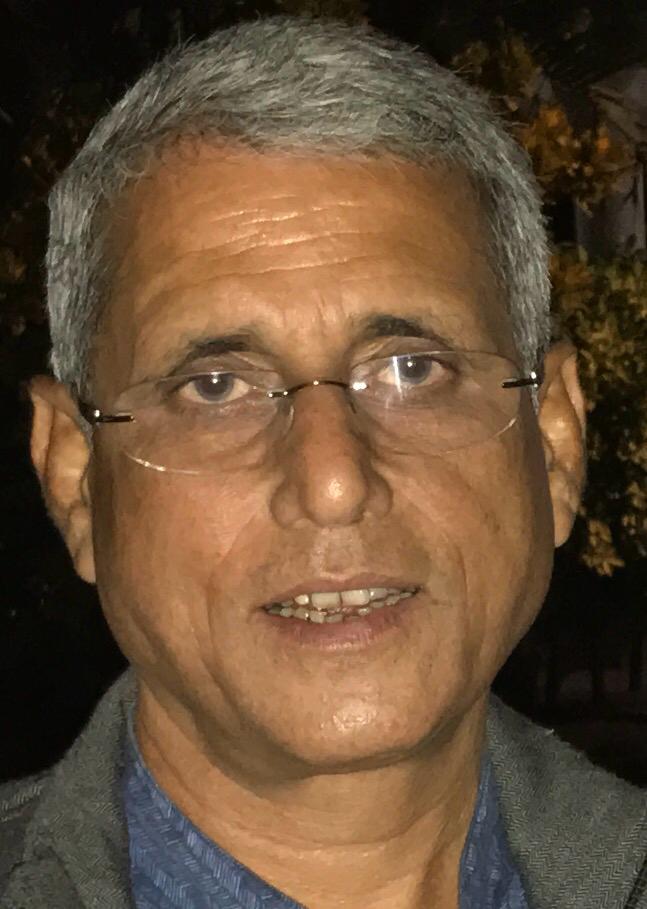

The recovery would necessitate not only increased public expenditure but also economy-wide reforms. To start economic activities and provide employment on one hand, and combat the pandemic on the other is going to be a task of gargantuan proportion for both the central government and State governments. Dr Manas R Das The National Statistics Office (NSO), on August 31, 2020, released the Gross Domestic Product (GDP) estimates for the first quarter (Q1) (April-June) of 2020-21. According to the estimates, GDP at constant (2011-12) prices in Q1 stood at Rs.26.90 lakh crore which was a whopping 23.9% below that in 2019-20Q1. The hugely negative growth rate was in striking contrast with the positive 5.2% growth recorded in 2019-20Q1. Similarly, the Gross Value Added (GVA) at basic price at constant (2011-12) prices for 2020-21Q1 was estimated at Rs.25.53 lakh crore indicating a gigantic 22.8% decline over that in 2019-20 Q1 (See Chart 1). {"align":"center","id":68277,"width":522,"height":392,"sizeSlug":"large"} At current prices, GDP in 2020-21Q1 was estimated at Rs.38.08 lakh crore which was substantially lower by 22.6% than that a year ago. This compared highly unfavourably with the 8.1% growth recorded in the similar period previous year. At basic price current prices, GVA was estimated at Rs.35.66 lakh crore in 2020-21Q1 – a year-on-year contraction of 20.6%. All the three sub-sectors of Industrial Index of Production – Mining, Manufacturing and Electricity - contracted in the range of 15.8% to 40.7%. Among the core sectors, production of coal, steel, crude oil and cement declined in the range of 6.5% to 56.8%. Some of the lead indicators such as sales of commercial vehicles, cargoes handled at major sea ports and airports, and passengers handled at airports reflected visible declines. The same was true for passengers and goods traffic handled by the railways. In the financial sector, bank deposits as well as loans remained sluggish. In terms of the premium collected by the Life Insurance Corporation, the linked schemes grew perceptibly, whereas the non-linked schemes fell. Table 1 presents a comparative view of the sub-sectoral growth rates in GVA. Table 1: GVA Sub-sectoral Growth Rates in Q1 at Constant (2011-12) Prices wp:table Sub-sectors2019-20 Q12020-21 Q1Agriculture, forestry & fishing3.0%3.4%Mining & quarrying4.7%-23.3%Manufacturing3.0%-39.3%Electricity, gas, water supply & other utility services8.8%-7.0%Construction5.2%-50.3%Trade, hotels, transport, communication & services related to broadcasting3.5%-47.0%Financial, real estate & professional services6.0%-5.3%Public administration, defence & other services7.7%-10.3% /wp:table The contraction in economic activities was quite well expected due to the Covid-19 and the shutdowns – both at national and local levels - that followed for a prolonged period of time. This adversely affected not only output and employment but also “data collection mechanisms”. Therefore, the NSO notes that the above-mentioned estimates are “likely to undergo revisions”. Following this, many economic forecasting agencies have further revised their estimates downwards for the next financial year. For instance, Goldman Sachs, Fitch and India Ratings forecast respectively 14.8%, 10.5% and 11.8% contraction in FY 2021. It is widely expected that India will witness a V-shaped recovery. However, the recovery would necessitate not only increased public expenditure but also economy-wide reforms. Raghuram G. Rajan, former RBI governor, opines that reforms have to be used as a stimulus. All these will have serious fiscal and monetary implications too. To start economic activities and provide employment on one hand, and combat the pandemic on the other is going to be a task of gargantuan proportion for both the central government and State governments. About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

Odisha election 2024: Central Election Committ...

Odisha: Devotees in Puri suffer to walk down s...

Odia Actress Naina Dash to work on Nagada

Heat wave: Four places in Odisha record temp a...

Heatwave continues to prevail in Odisha

BSE Sensex up 42 points, analysts predict tens...

Firing at Salman Khan’s house: Accused alleged...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.