2020-21 Second Advance Estimates of National Income

Real GDP is estimated to show a contraction of eight percent during 2020-21, as compared to four percent growth rate in 2019-20. In order to return to a growth trajectory of seven to eight percent the Budget for 2021-22 has laid a strong foundation. Dr Manas R Das The National Statistics Office announced the Second Advance Estimates (SAE) of national income for the Financial Year 2020-21 on February 26, 2021. According to the estimates, real GDP (at 2011-12 prices) is estimated to show a contraction of eight percent during 2020-21, as compared to the growth rate of four percent in 2019-20. RBI in its December 4, 2020 monetary policy statement had projected real GDP to grow by -7.5% in 2020-21. Similarly, IMF has forecast the Indian economy to shrink by eight percent in the current fiscal. Gross Value Added (GVA) at basic prices (at 2011-12 prices) is estimated to decline by 6.5% as against 4.1% growth achieved in 2019-20 (Chart 1). {"id":100852,"sizeSlug":"large","linkDestination":"none"} Table 1 presents GVA growth rates as per the three constituting sectors. It may be observed that compared to 2019-20 all the sectoral growth rates are likely to decline in 2020-21 with industry and services in negative territory. {"id":100853,"width":572,"height":235,"sizeSlug":"large","linkDestination":"none"} Within ‘Industry’, ‘Mining & Quarrying’ and ‘Manufacturing’ are estimated to contract by 9.2% and 8.4% respectively, whereas ‘Electricity, Gas, Water Supply & Other Utility Services’ is likely to post positive growth rate at 1.8%. Within ‘Services’, growth rates for all the sub-sectors during 2020-21 are likely to stay in the negative zone led by ‘Trade, Hotels, Transport, Communication and Services related to Broadcasting’ at -18.0%, followed in succession by ‘Construction’ at -10.3%, ‘Public Administration, Defence and Other Services’ at -4.1% and ‘Financial, Real Estate & Professional Services’ at -1.4%. Table 2 presents the expenditure side of GDP. {"id":100854,"width":608,"height":168,"sizeSlug":"large","linkDestination":"none"} Demand side analysis of GDP revealed that growth in PFCE during 2020-21, which accounts for over 56% of GDP, will likely remain in negative territory, implying continued weak demand conditions. GFCE growth rate, albeit positive, is estimated to go down indicating less public expenditure. Large contraction in GFCF or investment is not heartening. Available indicators reveal that the Indian economy is looking up. The Union Budget for 2021-22 has paved the way for attainment of a reasonably high growth rate to be supported by increased aggregate demand. The Budget also supports creation of jobs. Once employment situation takes a positive turn, demand will further grow and so would economic growth. Optimism is visible in various forecasts that are being made about the country’s macroeconomy for FY 22. The accommodative stance of the monetary policy will help sustain the growth. About the Author: Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

Naval Dockyard Mumbai announces recruitment dr...

Supreme Court to issue directions on mandatory...

To combat sexual violence in conflicts, India...

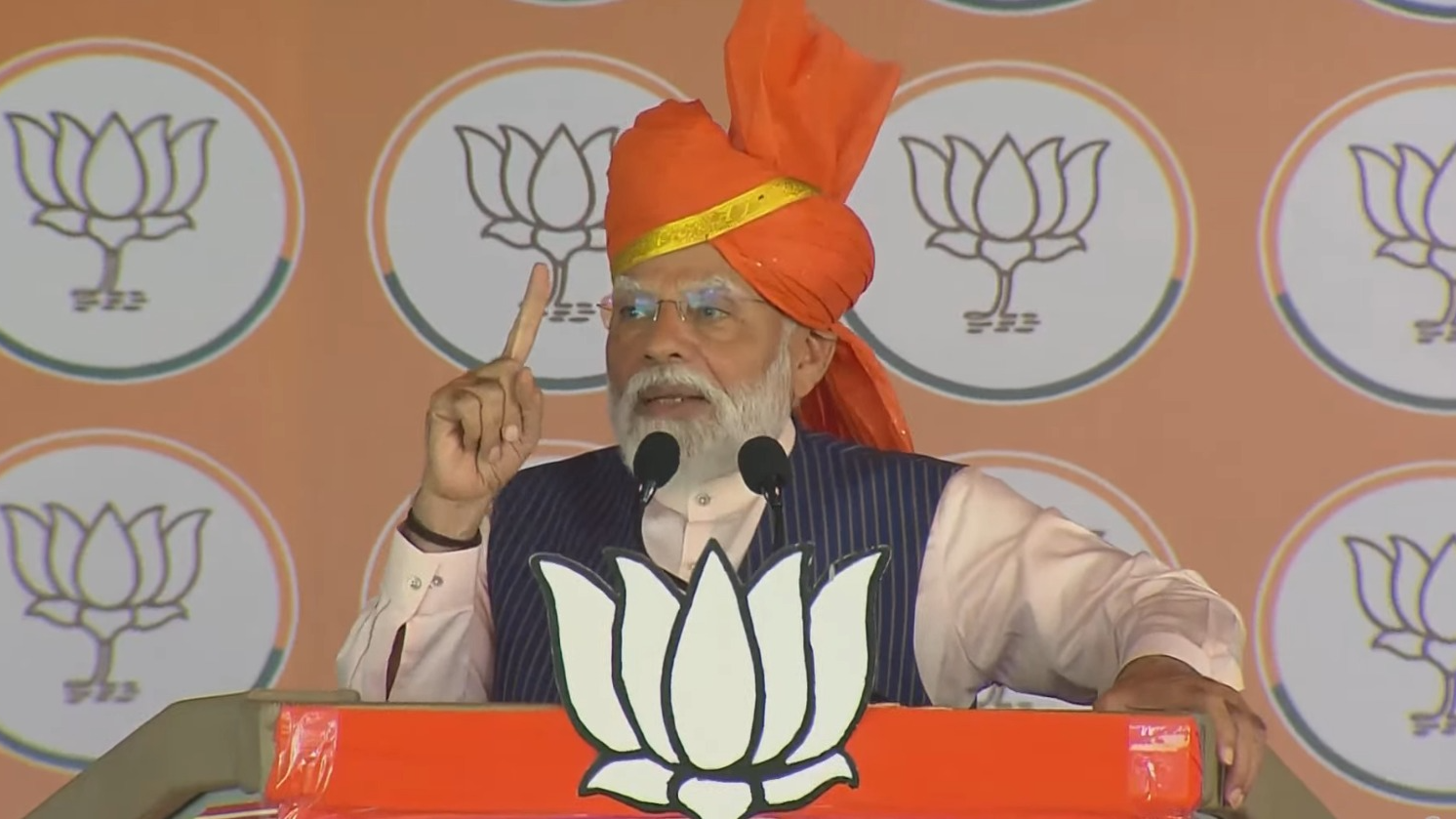

PM Modi to address public meetings in Chhattis...

Odisha Assembly polls: After quitting BJD, Hin...

Ahead of election, Odisha police seize Rs 30L...

Dance legends unite: Madhuri Dixit and Karisma...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.