Pradhan Mantri Jan-Dhan Yojana Surges Ahead

According to the World Bank’s Global Findex Database (2017), 80.0% of the adults in India had an account with a formal financial institution, up from 53.0% in 2014 and 35.0% in 2011 Findex Databases, thereby indicating that the extent of financial exclusion is diminishing, especially owing to the dedicated financial inclusion programmes like PMJDY. Dr Manas R Das Pradhan Mantri Jan-Dhan Yojana (PMJDY) was launched on August 28, 2014 under the National Mission for Financial Inclusion. It envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension. The PMJDY account holders are(a) provided with Rupay Debit cards, (b) eligible for Direct Benefit Transfer and (c) eligible for MUDRA loans. Besides, eligible account holders can avail of an overdraft facility up to Rs 10,000. PMJDY has also provided a platform for three social security schemes, namely,Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Atal Pension Yojana. All-India Progress The progress under PMJDY has been remarkable both in terms of number of beneficiaries covered and deposits mobilised, as can be discerned from Chart 1. {"id":60755,"width":637,"height":325,"sizeSlug":"large"} Taking full years into account, during 2016-20, the total number of beneficiaries grew at a Compound Annual Growth Rate (CAGR) of 15.65% with those in urban and metropolitan areas registering a growth rate of 17.42%, and those in rural and semi-urban areas posting a growth rate of 14.49%. Total deposits in the PMJDY accounts registered a solid growth rate of nearly 35.0% during the above-mentioned period. Deposits per account revealed steady growth from Rs 1,665 in 2016 to Rs 3,090 in 2020 – a growth rate of 16.72%. While nearly six-tenth of the beneficiaries belonged to rural and semi-urban areas,the rest four-tenth to urban and metropolitan areas. However, during 2016-20,the share of the former came down by 83 bps with corresponding increase in that of the latter. The number of RuPay cards issued to the beneficiaries grew at 13.35 % during 2016-20 to reach over 29 crore at March-end 2020. As per the latest data available, as on July 29, 2020, the total number of beneficiaries crossed the 40-crore mark with amount in accounts at nearly Rs 130 thousand crore, yielding Rs 3,233 as deposits per account which was almost twice the amount at March-end 2016. The number of Rupay cards issued marginally fell short of the 30-crore mark. Odisha’s Position As on August 5, 2020, Odisha had 1.26 crore PMJDY beneficiaries which was 3.14% of the country total.Of the total, 77% belonged to rural and semi-urban areas and the rest 23% to urban areas.The deposits in accounts totalled a little over Rs 6,075 crore which was 4.68% of the country total. The average deposits per beneficiary worked out to Rs 3,710 which exceeded the country average by 14.77%. The number of Rupay cards issued stood at 1.31 crore accounting for 4.43% of the country total. Concluding Remarks Despite noteworthy accomplishments under PMJDY, still a section of households is financially excluded. According to the World Bank’s Global Findex Database (2017), 80.0% of the adults in India had an account with a formal financial institution, up from 53.0% in 2014 and 35.0% in 2011 Findex Databases, thereby indicating that the extent of financial exclusion is diminishing, especially owing to the dedicated financial inclusion programmes like PMJDY. The remaining gap, however, needs to be bridged. The role the public sector banks and Regional Rural Banks, which has been pivotal in financial inclusion, will continue to remain so in future. However, it must be emphasized that the usage of accounts by the beneficiaries should improve continually so that banking becomes a ‘habit’ with them. About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

SSB Odisha to release provisional answer keys...

Odisha’s Climate Project wins top award at Sea...

Sitharaman, Purandeswari, Srinivasan: The Top...

Vigilance raid: Talcher ASI caught taking brib...

Assault on BMC official: OAS officers to resum...

Air India Crash: UK Families Retain Law Firm f...

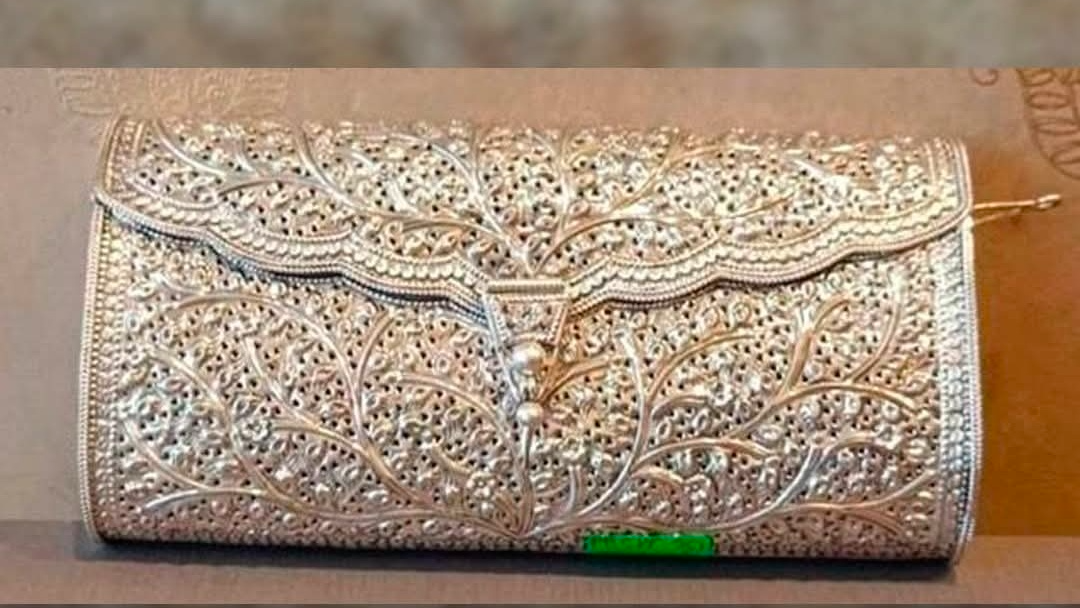

PM Modi gifts silver filigree purse to Ghana’s...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.