Odisha now doesn’t require any more Urban Cooperative Banks

Odisha, which is served by a good network of commercial banks, doesn’t require, at present, any more urban cooperative banks (UCBs). However, the option of allowing strong and viable UCBs, in future, may be kept open. Dr Manas R Das The origin of the Urban Cooperative Banks (UCBs) can possibly be traced to the ‘Anyonya Sahakari Mandali’ organised in the erstwhile princely State of Baroda in 1889 under the guidance of Vithal Laxman, popularly known as Bhausaheb Kavthekar. At the outset, urban cooperative credit societies were organised on a community basis in order to meet the credit needs of their members, especially for consumption purposes. Salary earners’ societies, aimed at encouraging thrift and self-help among the middle class and organized labour, bolstered the movement. Historically, UCBs have focused on mobilising savings from low- and middle-income urban population and providing credit to their members, many of whom being from weaker sections. The traditional focus continues even today. The history of cooperative movement reveals that several rigorous efforts have been made to impart cooperatives in general and UCBs in particular their pride of place. The unveiling of the RBI’s “Vision Document for UCBs” (2005) is regarded as a landmark event in the history of UCBs. Table 1 provides a profile of UCBs at March-end 2019 (latest available). {"id":63673,"width":589,"height":288,"sizeSlug":"large"} One of the striking but worrisome features of UCBs is their concentration in a few States/regions. As can be observed from Chart 1, nearly 72% of the UCBs in the country are located in four States only, i.e., Maharashtra and Gujarat in the western region, and Karnataka and Tamil Nadu in the southern region. The 1,107 UCBs in these four States commanded 80% of branches, 85% of ATMs, and 84% each of deposits and advances owned by all the UCBs in the country. {"id":63675,"width":585,"height":334,"sizeSlug":"large"} Such concentration of banks in geographically contiguous regions is undesirable, especially at the time of a bank run, which escalates the contagion risk. However, the sizes of cooperative banks are too small to jeopardize systemic stability in any way, although intra-segment problems cannot be ruled out fully. UCBs in Odisha At March-end 2019, Odisha had just nine UCBs – all non-scheduled banks - with 32 branches. In these respects, Odisha was second to West Bengal in the eastern region where 58 UCBs with 138 branches were present at March-end 2019.In Odisha, out of 30 districts, 11 or 37% had a presence of UCB as compared to 30 out of 122 or 25% in the eastern region.There was no UCB ATM in Odisha although the region had 20 of those. Deposits of UCBs in Odisha stood at about Rs.1,235 crore constituting nearly 17% of the regional total. Similarly,advances stood at a little over Rs.742 crore constituting about 19% of the regional total. The credit-deposit ratio of the Odisha UCBs worked out to 60% as against the regional ratio of 54%. Table 2 presents an aggregate profile of UCBs in Odisha vis-à-vis the eastern region and country. {"id":63677,"sizeSlug":"large"} Thus, from the all-India perspective, UCBs have a minuscule role to play in the financial sector and economy of Odisha. Concluding Remarks UCBs are observed to be fragile for which ‘dual’ control’, (i.e., they are registered with the Registrars of Cooperative Societies of the States under the Cooperative Societies Act, 1912 and regulated by RBI under the Banking Regulation Act, 1949 and Banking Laws (Application to Co-operative Societies) Act, 1965) is majorly held responsible. Besides the confusion it creates, the ‘dual control’ exacerbates external influence in the working of UCBs. However, with the promulgation of the Banking Regulation (Amendment) Ordinance, 2020, which will bring all UCBs and multi-State cooperative banks under RBI supervision to protect the interests of depositors, this problem will likely recede. Further, there’s a need to reduce their geographical concentration. Odisha, which is served by a good network of commercial banks, doesn’t require, at present, any more UCBs. However, the option of allowing strong and viable UCBs, in future, may be kept open. About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

ISKCON Hails Gautam Adani's Humble Service at...

Odisha: BMC Additional Commissioner Ratnakar S...

Similipal Tigress Zeenat, who roamed 3 states,...

Train services disrupted due to landslide on K...

Rajkummar Rao to play Sourav Ganguly in upcomi...

SOA Vice-President stresses need to empower nu...

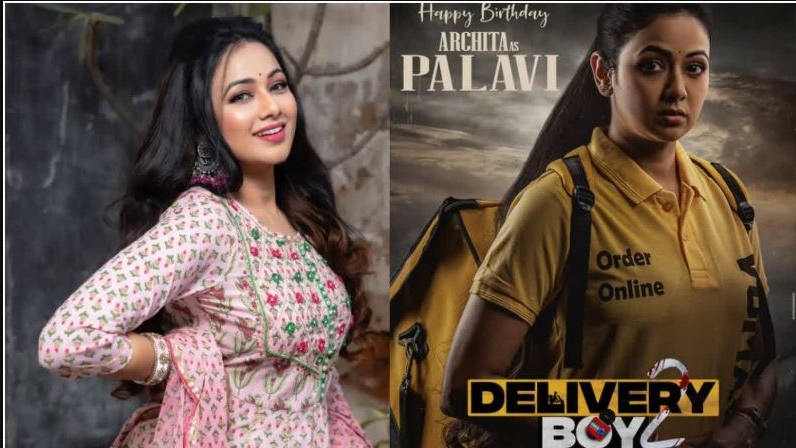

Archita gears up for a powerful comeback as 'P...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.