Odisha: holds good promise for life insurance

The State holds good promise for life insurance. Since Odisha is a low-income State, the role of insurance as a ‘push’ business in contrast to a ‘pull’ business needs to come into increasing play. Therefore, the insurers have to make efforts by designing appropriate products (especially, low-premium and less complex products), spreading awareness, motivating the people to insure themselves, explaining the products to them patiently, minimizing mis-selling and providing enhanced follow-up services. Dr. Manas R Das Last week, this column commented on the non-life (General) insurance sector in Odisha. Today, it focuses on the life insurance sector. Globally, in terms of life insurance, India still remains one of the under-insured countries with penetration, i.e., premiums as a percentage of GDP at 2.74% (world = 3.31%) and density, i.e., per capita premium at USD 55 (world = USD 370) (2018). Taking into account new business premium (i.e., first year premium and single premium) underwritten for ‘individual’ and ‘group’ categories, we computed the (life insurance) penetration and density in respect of Odisha for six years, i.e., 2013-14 to 2018-19. Table 1 illustrating the results reveals continuously increasing trends from 2015-16 onwards for both the metrics. However, despite the up trends, Odisha lagged the country. {"id":54849,"sizeSlug":"large"} Charts 1 and 2 present the number of life insurances policies and new business premium for Odisha and its comparison with India for the period 2013-14 to 2018-19. {"id":54850,"sizeSlug":"large"} The number of policies showed a declining trend which was in sync with the all-India trend.However, the compound annual decay rate in respect of Odisha at 2.8% was far better than that for the country at 8.5%. As proportion of the all-India figures, the number of policies in respect of Odisha showed a continuous upward trend from 3.8% to 4.7% during 2013-14 to 2018-19. As regards premium, Odisha posted a compound annual growth rate of 14.5% which was higher than that for all-India at about 12.5%. As a result,the premium per policy in Odisha which was a little above`10,000 in 2013-14 climbed up to over`23,000 in 2018-19.In spite of this, over the said period, the per policy premium (Odisha) remained below that for the country by a significant margin of 21% to 36% reflecting the lack of high-value policies, the State being a low-income one.As proportion of the all-India figures, the premium rose up to 3.2% in 2018-19 despite slides in the preceding two years. In the ‘group’ life business, during 2013-14 to 2018-19, the number of schemes showed an uneven trend, but premium and number of lives covered showed, by and large, an increasing trend. As proportion of the respective all-India numbers, they remained low,but showed some signs of improvement. Odisha is still not adequately served by life insurance. The factors responsible there for chiefly include: (a) preponderance of low-income people without sufficient propensity to save, (b) lack of awareness about or interest in various financial products in general and insurance in particular, which is linked to (a), (c) peoples’ fatalistic attitude towards life which is exacerbated by limited sensitisation efforts and (d) due to these, life insurers do not reckon Odisha as a good potential centre and therefore do not give their best. At the same time, the State holds good promise for life insurance. Since Odisha is a low-income State, the role of insurance as a ‘push’ business in contrast to a ‘pull’ business needs to come into increasing play. Therefore, the insurers have to make efforts by designing appropriate products (especially, low-premium and less complex products), spreading awareness, motivating the people to insure themselves, explaining the products to them patiently, minimizing mis-selling and providing enhanced follow-up services. About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

RRBs to offer over 50,000 appointments in FY 2...

Odisha couple forced to plough field like oxen...

Odisha: Man hacks brother to death over past e...

Chunav Chori happened in Maharashtra, now plan...

BJP & BJD allowing 5-6 companies to exploit Od...

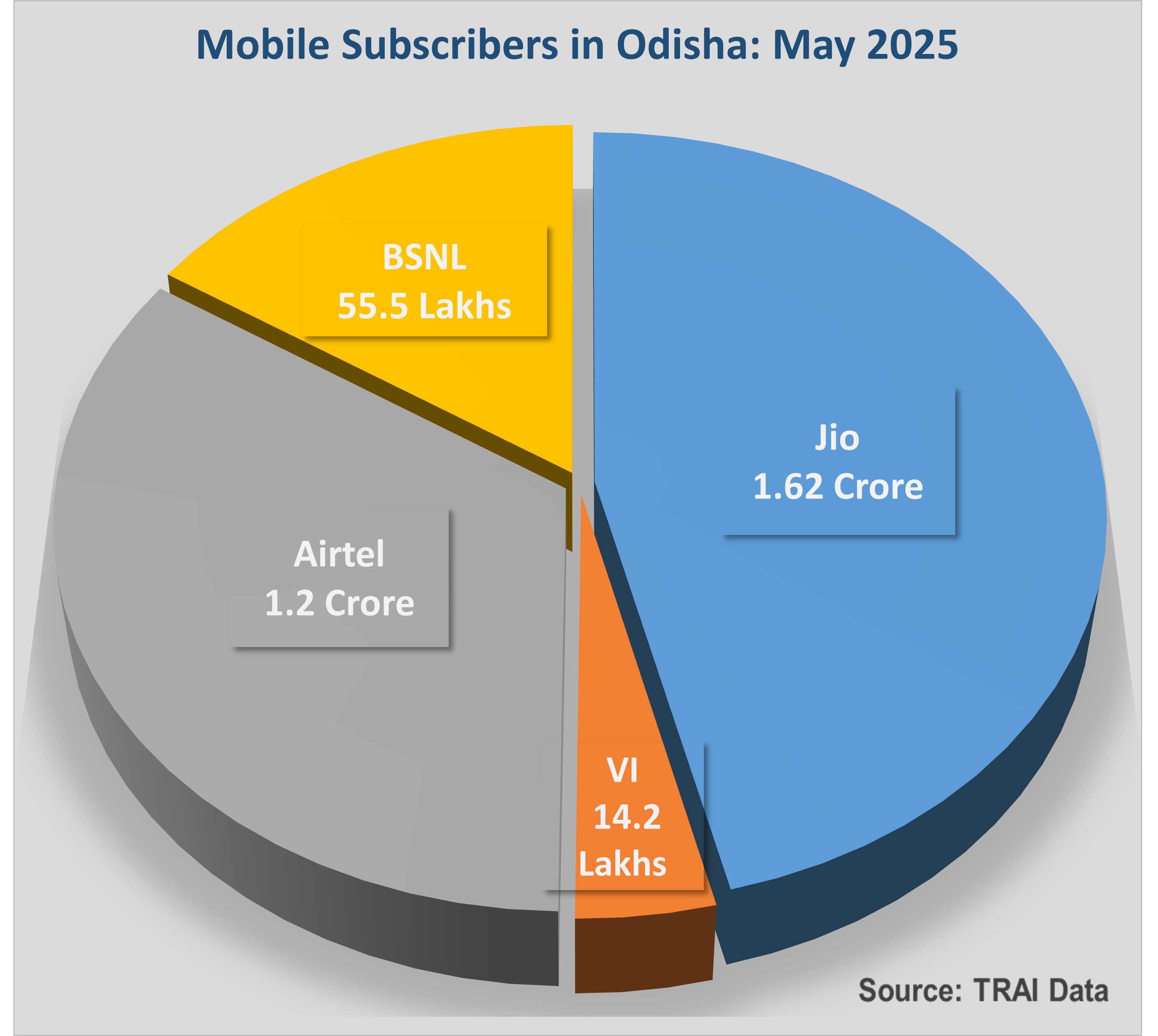

Jio adds highest 1.54 lakh new mobile subscrib...

Brown Sugar worth ₹15 lakh seized from mixture...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.