Business Ethics and Banking

Ethics should rule customer service rendered by banks. Business etiquette should be an integral part of ethical customer service. Bankers need to be trained in this. Dr Manas R Das Banking is no ordinary business. Banks are ‘special’ business units which, as financial intermediaries, borrow money from savers toon-lend for productive ventures. Thus, the underlying is one of the riskiest things in the world, i.e., money and money alone. Banks run on public trust which in turn is a function of ethical principles and moral values that banks follow. The world is witness to numerous bank failures, small and large, which could not withstand the rigor of public trust. The ethical principles that banks follow are and ought to be of high order compared to those followed by any other businesses. Depositors A depositor saves his hard-earned money in a bank first and foremost for ‘safety’ and then ‘return’. By ‘safety’ we mean safety from theft or burglary as well as safety of the ‘intrinsic’ value of money. For example, normally, if a depositor deposits Rs.100/-in his bank, he will definitely get back his nominal Rs.100/- + some interest after the contractual period. However, economically speaking, does the value of money, in real terms, remain same over time? No. Due to inflation, if any, its real value erodes. Hence, the first ethical principle that banks should follow with respect to their depositors is to protect the ‘real’ value of money by providing an interest rate which would eventually not only neutralize the impact of inflation but also give a positive ‘real’ return over the contractual period. Ours is a bank-driven economy unlike many western countries which are capital market-driven. Therefore, from the viewpoint of the economy as also the savers banks must give ‘inflation+’ return to savers. The second ethical question is the protection of small depositors’ money from bank failures. In our country, a depositor’s deposit is insured by the Deposit Insurance & Credit Guarantee Corporation upto Rs.5 lakh, recently increased from Rs.1 lakh that was set in 1993. However, quick resolution of troubled or failed banks is necessary too. Customer Service Ethics should rule customer service rendered by banks. Business etiquette should be an integral part of ethical customer service. Bankers need to be trained in this. Fundamentally, banks should not differentiate between customer service rendered to small customers and large customers. The service charges levied by banks should be as objectively determined as possible. It is widely acknowledged that banking being a service industry pricing of banks’ services is an uphill task. However, there are statistical methods to ‘approximate’ costs and charges to their ‘realistic’ levels. Over years, banks have benefited substantially from computerization in the form of cost-saving. It needs to be seen the extent to which banks have passed on these benefits to their customers. Whether it is a depositor or borrower or simple service seeker there should not be any hidden charges which crop up from time to time thanks to ‘fine prints’. Accounting and Disclosures Banks’ Balance Sheets and Profit & Loss Accounts along with other statutory disclosures must reflect the true scenario of banks. Data purity and integrity is of paramount importance for banks from the viewpoint of all stakeholders. In many countries, including ours, manipulating accounting and disclosures is a cognizable offence which attracts heavy penalty. Corporate governance holds the key here. Banks must adhere to the highest corporate governance standards prescribed by their regulators/supervisors. Employees Banks should follow ethical practices as far as their own employees are concerned. If employees are demoralized by unethical policies relating to their service conditions, their frustration would be reflected in banks’ businesses, howsoever ethical it may be to its customers. There shouldn’t be any harassment of and discrimination between employees or employee categories. RBI’s Role RBI has taken several innovative measures to promote ethical practices in banking businesses. Apart from its guidelines issued to banks from time to time on all banking matters, it has created certain institutions like the Banking Codes and Standards Board of India and the Banking Ombudsman to safeguard interests of customers. From bankers’ side, the Indian Banks’ Association acts as a self-regulator. Conclusion Ultimately, a bank’s Board and Management must balance the ideal against the practical – the need to produce a reasonable profit for the bank’s shareholders with honesty in business practices, safety in the workplace, and larger environmental and social issues. It’s heartening to note that banks in India have appointed Chief Ethics Officers. About the Author:Dr. Manas R. Das is a former senior economist of State Bank of India. He has over 30 years of experience as an economist in two large commercial banks. Academically, he is a gold medallist in Bachelor of Arts with Economics Honours from Utkal University, followed by Master’s in Economics from Delhi School of Economics and Doctorate in Economics from Gokhale Institute of Politics and Economics. He is also a Certified Associate of Indian Institute of Bankers. He has won several awards, besides being a prolific writer.

Latest News

Odisha: Youth dies after being stabbed 16 time...

Vital organ, vital importance: Why maintaining...

Apple spotlights India's talent: 5 filmmakers...

Miscreants rob Rs 9.26 lakh cash from bank at...

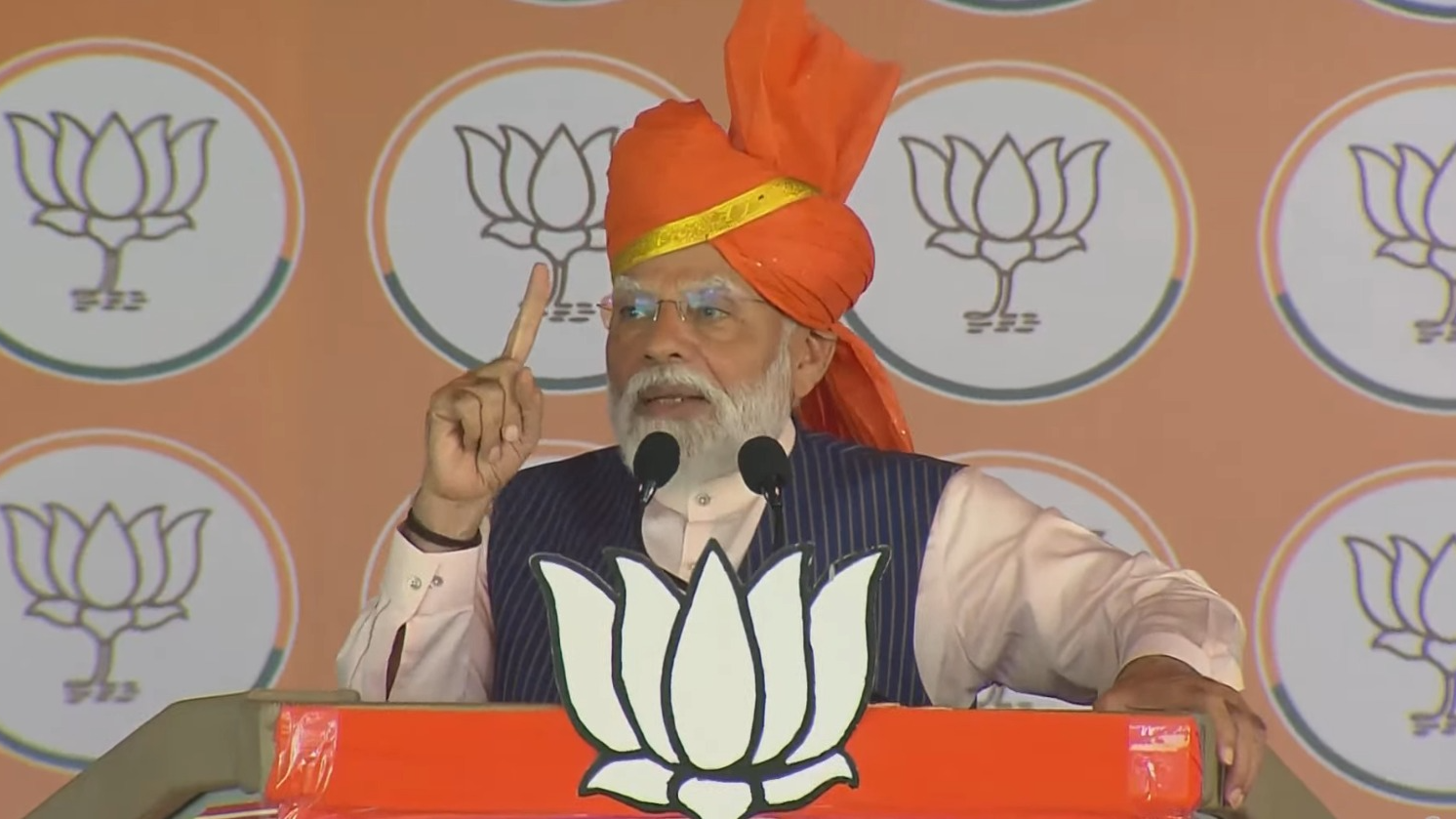

Lok Sabha polls 2024: Will register historic w...

LS polls 2024: PM Modi to campaign in UP, MP a...

Vice-Admiral Dinesh Tripathi appointed as new...

Copyright © 2024 - Summa Real Media Private Limited. All Rights Reserved.